Organisations that are registering with the SMCR (Senior Managers Certification Regime) can now complete an online course from just £30.00, thanks to a new eLearning course from RQC Group.

For regulated firms working in banking, insurance and investments, the SMCR regime is compulsory to continue trading, with an original deadline set in September 2020, which has been now extended to 31st March 2021 (due to covid-19).

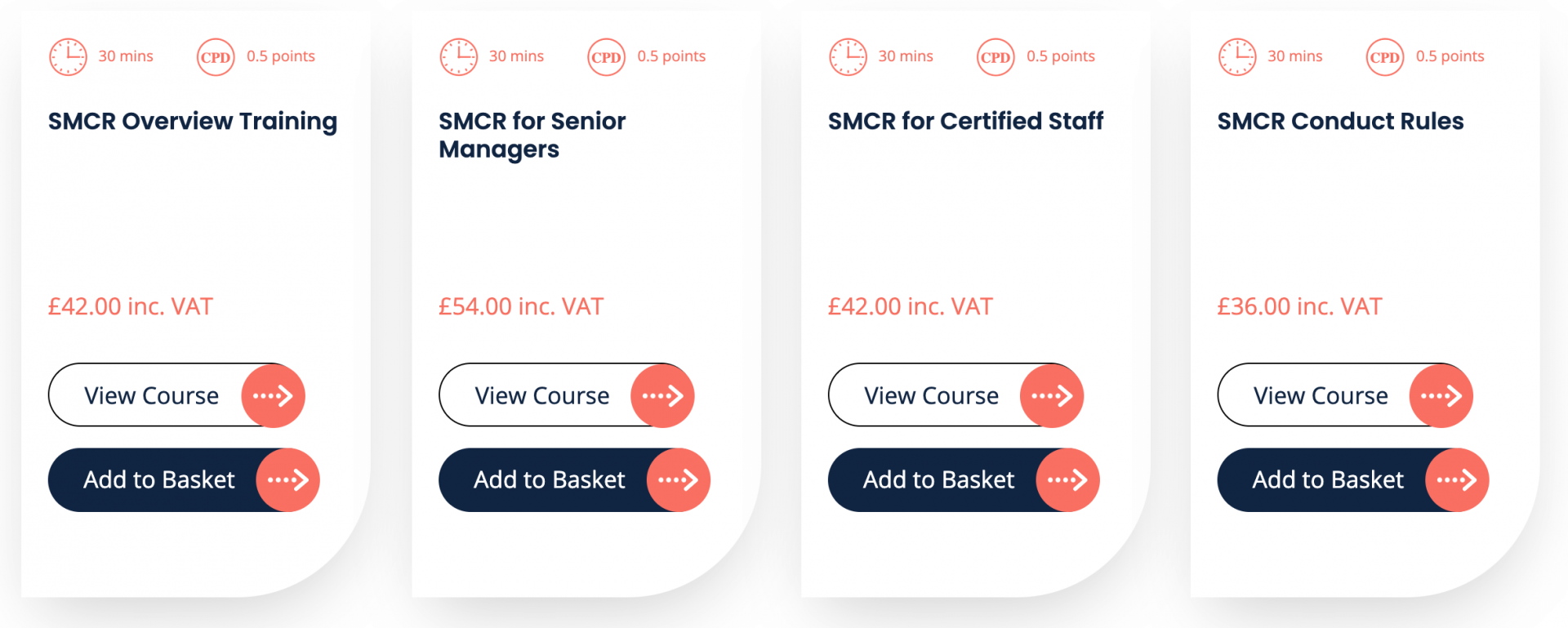

Employees and organisations can complete an SMCR course online through the RQC Group website, taking just a 30-minute or 45-minute course and participants can receive a downloadable CPD-accredited course certificate upon completion.

Proudly in partnership with:

What is Covered in SMCR Training Courses?

- SMCR Overview

- SMC Senior Manager’s Regime

- SMCR Certification Regime

- SMCR Conduct Rules

The SMCR overview is the perfect starting place, which applies at all levels within a financial institution, or the entity that is providing financial services. The Senior Managers Regime is designed to improve accountability at the top level. The Certification Regime requires certain key employees to be vetted at least once per year to ensure they are fit and proper and follow the right side of regulation. The SMCR Conduct Rules is a newly introduced code of conduct for the financial services industry and it applies to employees across the board.

Bespoke to three categories of ‘Solo’ regulated Firms

- Limited Scope Firms

- Core Firms

- Enhanced Firms

What is Included in the SMCR Courses from RQC Group?

- 1 course per employee

- Courses are 30 to 45 minutes

- Cost ranges rom £30 to £54 per course

- All courses are streamed online

- All courses can be watched in full, paused and picked up at your convenience

- Followed by questions to test your understanding and knowledge of SMCR material

- Downloadable CPD-accredited course certificate upon completion

What is SMCR?

The SMCR (Senior Managers and Compliance Regime) was introduced in 2016 by the Financial Conduct Authority to better regulate financial institutions such as banks – and the regime extends to over 60,000 entities across the UK.

This new regulation was introduced to ‘increase accountability’ for senior managers who are offering advice or processing large investments on behalf of their clients.

Following the financial crisis in 2008 where individuals and firms suffered dramatic losses, it was difficult to assign accountability and responsibility, with a lot of senior personnel hiding behind their large organisations.

The SMCR regime aims to overcome this, putting senior managers at the forefront of the regime and holding individuals and staff members responsible for financial investments and transactions, particularly those exposed to large risks.

When is the SMCR Deadline?

The SMCR deadline is 31st March 2021 and any regulated firms and their employees must be certified and approved by SMCR standards to continue operating in their field of banking, finance, credit, insurance and more.

What Type of Companies Are SMCR Regulated?

The total addressable market for SMCR in the UK is around 60,000 FCA-regulated firms – including senior managers and their employees across:

- Banks

- Building societies

- Credit unions,

- Claims management companies,

- Consumer credit firms

- Electronic money and payment institutions

- Financial advisers,

- General insurers and insurance intermediaries

- Investment managers

- Life insurers

- Pension providers

Thinking About SMCR Courses? Get a Free Demo

Users can also access a free demo course that takes just 15 minutes to be complete, for a tangible experience of the content and user-experience of the courses.