Company: Yonder

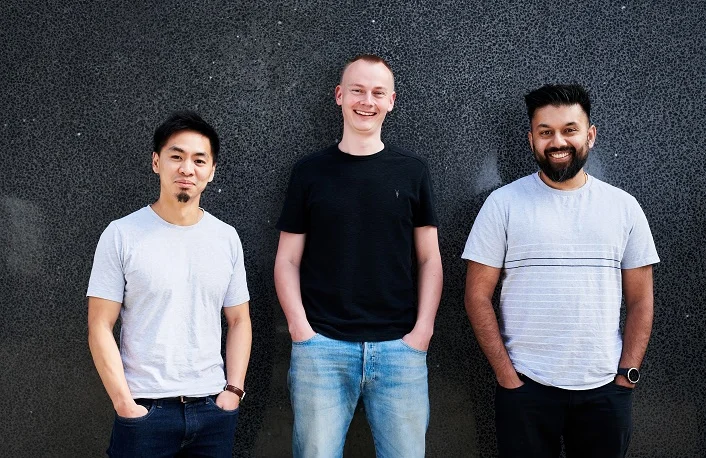

Founders: Tim Chong, Theso Jivajirajah, Harry Jell

Website: https://www.yondercard.com/

About Yonder

Yonder is a next-generation credit card for city adventurers, which helps young people to build good credit habits while enjoying rewards in their city’s finest bars, pubs, restaurants and lifestyle hotspots. The company uses a combination of banking technology and a distinctive rewards programme to create a unique credit product for young professionals.

Yonder’s founders Tim Chong, Theso Jivajirajah and Harry Jell met while working at ClearScore. They found there to be a lack of credit options to suit expats in the UK, and they were inspired to start Yonder after seeing how the credit sector wasn’t set up to meet customer needs.

Yonder’s mission is to rebuild the world’s relationship with credit, by showing people that responsible use of credit can unlock new experiences and adventures.

Yonder differentiates itself in three ways:

1. Its suitability for those with no UK credit score: Yonder is one of the first credit cards to use open banking for a more personalised view of applicant spending habits, allowing the underwriting of those with no, or thin, credit reports in the UK

2. A unique rewards model: Yonder’s rewards programme is built on a fair value exchange model and was developed following months of research. Earned points can be redeemed at a variety of curated hospitality and lifestyle experiences that change monthly. Points have no restrictions or expiry dates, and a membership comes with no fees abroad and worldwide travel insurance

3. A beautiful user experience: Yonder’s app has been built to feel more like a financial membership than a banking product. Points can be redeemed instantly with a swipe in the app, Yonder’s 24/7 customer service has an average response time of 3 minutes and any accrued interest is clearly explained if members choose not to pay off their bill in full every month

Yonder has secured more than £18m in equity investment since February 2022 and has had investment from a number of angel investors including Rio Ferdinand.

Funding round totals below:

£850,000 raised in pre-seed round (Feb 22)

£5m equity and £15m debt raised in seed round (March 22)

£13.2m equity and £50m debt raised in Series A round and crowdfund (April 23)

Since launching in April 2022, more than 20,000 people have applied for a Yonder card, members have spent £30m through almost 1m transactions and daily active use is at 70%. As of the end of March 2023, annual recurring revenue was over £1m and headcount was 23.

Yonder’s ultimate goal is for people to use credit cards the way they use their debit cards, enabling them to build credit scores responsibly while accessing a variety of financial benefits. Following Yonder’s Series A fundraise which resulted in a post-money valuation of more than £70m, plans include product development (expanding into new rewards sectors, solving deep underwriting problems and breaking barriers between credit and debt), expanding into new cities and doubling the team.

As part of Yonder’s mission to transform how consumers interact with credit, the long term ambition is to drive unparalleled, borderless access to credit wherever you are in the world. This means offering frictionless payments, seamless cash flow management, curated discovery of personalised experiences based on your spending habits and even memorable reward experiences spanning from exclusive dining, immersive music gigs or chauffeur services, to Yonder spaces across airports and major cities.