- Cuvva is an insurance company based in London, launched in 2016 by CEO Freddy Macnamara.

- Cuvva was the first insurance company to sell hourly car insurance policies, and the first to sell policies through an app.

- Cuvva is the most downloaded insurance app in the UK and in December 2019, Cuvva was responsible for selling 4.5% of all motor insurance policies in the UK by volume, according to MIB.

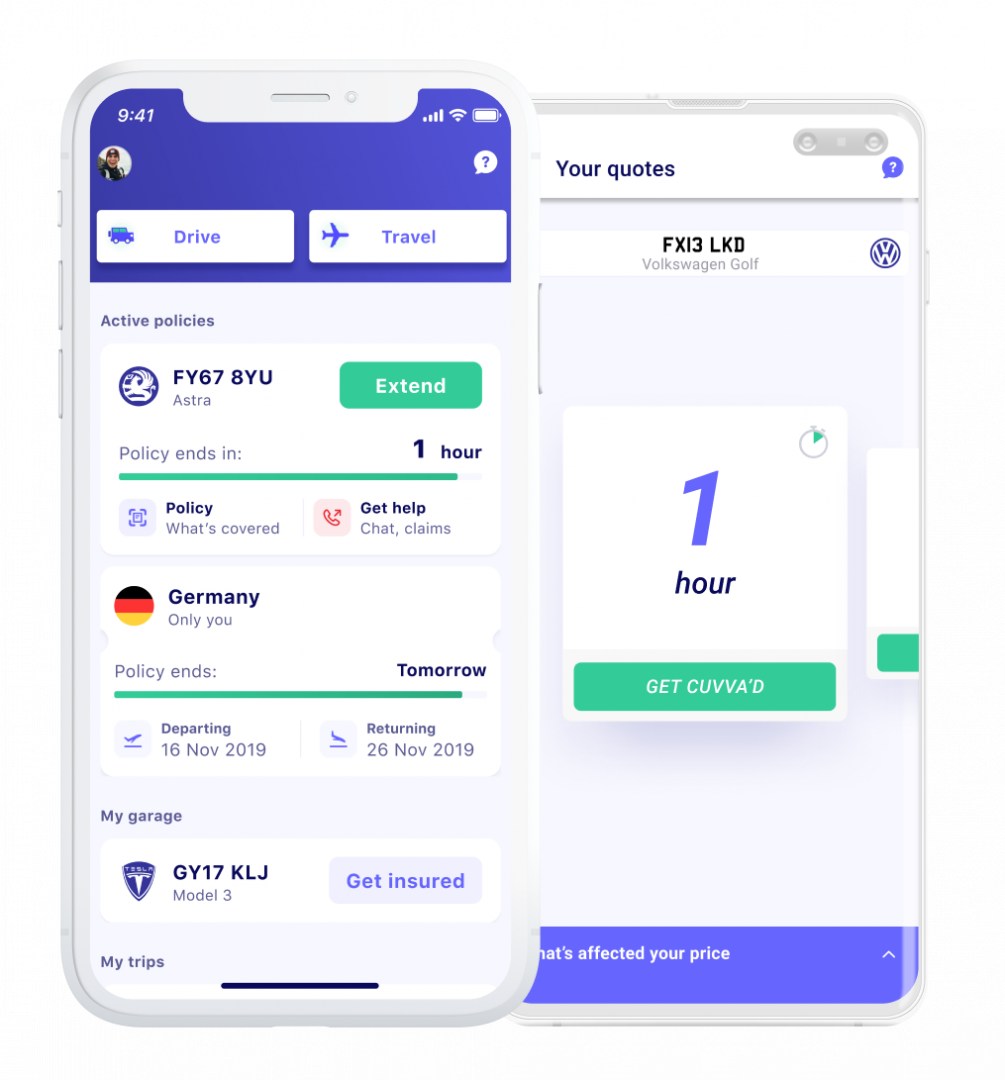

- Cuvva provides hourly car insurance and single trip travel insurance that can be bought in a couple of minutes via a user-friendly mobile app.

Who is Cuvva and what is the company ethos?

Freddy Macnamara: Cuvva is a startup, changing the way insurance is bought and sold in the UK by building flexible and simple products that are better suited towards people’s on-demand lifestyles. We provide hourly car insurance and single trip travel insurance that can be bought in a couple of minutes via a user-friendly mobile app.

Insurance doesn’t have to be so awful, complicated and humanless. We’ve flipped tradition on its head to build straightforward and transparent products with world-class customer support. Our in-app support has an average one minute response time 24/7, ensuring our customers feel completely supported throughout the process of purchasing insurance.

What are the main products that Cuvva offers, and how do they differ from products offered by other companies in the insurance market?

Since launching in 2016, we’ve grown to offer temporary personal car, learners and van insurance. In 2019, Cuvva launched flexible single trip travel insurance, which was our first foray into a new vertical.

The simplicity and functionality of the app means all your details are stored in your account. Customers don’t have to fill in their personal details every time they want to take out a new policy.

The startup is able to offer flexibility that rigid traditional insurance seems to lack, and are therefore able to cater for all sorts of personal insurance needs, including people on the move.

We understand that individual needs and circumstances continuously change and insurance needs to adapt accordingly. For example, you might only realise in the taxi on the way to the airport that you forget to take out travel insurance or you might have to drive a friend or family member’s car home, while out and about, but can’t afford to spend half an hour on the phone to an insurer. The insurance-in-your-pocket nature of Cuvva allows you to get covered instantaneously, in a couple of taps.

How has Cuvva developed from when you were first founded?

I initially started Cuvva when I couldn’t find flexible insurance to help me share my car. At that stage, I had no idea just how big the problem we are solving really is; a few years on, we’re now building a platform to manage all your general insurance needs, starting off with temporary car and travel insurance.

Next up will be the launch of a pay-monthly car insurance product that will offer the same flexibility and simplicity as temporary car cover and reassurance associated with annual cover. Not everyone can afford the upfront cost to purchase annual cover and nor do they want to be tied into annual contracts.

The monthly motor insurance products currently available in the UK are layered with additional fees and interest. Essentially when you opt into monthly car insurance, you’re taking out a loan to pay for your annual cover monthly, which isn’t always made clear at the outset.

The interest charged by insurers or third party providers is known to reach up to as much as 40% of an annual motor insurance premium in the UK. This leaves consumers inevitably paying far more for the same insurance policy in the long run, leaving them worse off.

Due to launch mid-year, Cuvva’s pay-monthly subscription model is aimed at solving this gap in the market, and it won’t charge its customers these additional fees or interest.

How has Cuvva incorporated technological advancements in their products?

Insurance by nature is very outdated. We’ve introduced technology into the sector, and built flexible products to connect customers directly with underwriters. The technology that we’ve built allows us to cut out various unnecessary layers in insurance, completely simplifying processes for our customers. By building our own platforms internally, we can make adjustments as and when needed, to ensure the customer’s evolving needs are always met.

What is Cuvva’s ‘five-year plan’?

We hope to be a household name, supporting all our customers insurance needs. Cuvva will be the place where you buy all your insurance, all through the mobile app.

What does Cuvva do to stay one-step ahead of its competitors in the insurance market?

Insurance as it stands no longer serves the needs of all it’s customers. People want simple, flexible insurance to suit their on-demand lifestyles. When it comes to the sharing economy and insurance, there are also major gaps.

We’re providing much needed solutions and breaking down barriers in an archaic industry. By completely modernising insurance products and processes, we’re able to provide consumers with top quality products they actually need.

We’re also building useful features in the app (currently available on iOS), to help our customers keep track of all things car related. From MOT and tax reminders to sharing tips regarding where to find the nearest and cheapest fuel. We’re building a platform where our customers can manage all aspects of their car in one place, in the app.

Instead of spending large sums of money on celebrity endorsements and TV ads, we’re focusing on building top quality products that essentially sells itself.

For more information, see https://www.cuvva.com/