Accounting is most entrepreneurs’ least favourite part of running a business, but it’s now simpler than ever to manage your books digitally. Most providers now offer both desktop and cloud-based solutions for your business’s accounts.

Specialised software can save hours of time over spreadsheets and paper-based systems; it also helps to ensure that you have every figure you need.

There are a plethora of bookkeeping suites out there to match every business and price point; here we’ve scoped out ten of the strongest and most popular options for small businesses in the UK.

Sage

Sage offers one of the most comprehensive suites for both desktop and online accounting. Businesses can choose from a range of different packages, including Sage Business Cloud Accounting, Sage 50cloud, Sage Financials and Sage Enterprise Management.

Sage Business Cloud Accounting is a solid choice for startups and small businesses; it covers sales invoices, payment tracking, balance sheets and VAT returns. Pricing starts at £10 per month.

Intuit QuickBooks

QuickBooks is another one of the big names in bookkeeping, and it offers a well-rounded account management package for businesses big and small.

Among its core features are tax estimates, deductible mileage tracking, payroll and VAT management; as with other programmes, you can create and send invoices directly from the QuickBooks dashboard.

QuickBooks tailors its packages to the type of business you run. The Self Employed plan costs just £8 per month and makes it easy to separate work and personal expenses. The app automatically tracks deductible mileage and at the end of the tax year all you need to do is copy and paste its figures into HMRC’s self-assessment form.

As a company, it’ll help you to manage stock, VAT, payroll, employee time and costs by project.

Pricing begins at £8 per month for self-employed business owners.

Tide

London fintech startup Tide offers a basic bookkeeping suite with its business banking accounts; transactions are neatly categorised and invoices are created, sent and paid with a couple of taps. Not content to rest there, Tide also syncs with Xero, Sage and FreeAgent for more comprehensive accounting.

Tide charges no monthly or annual fees on its accounts, only on bank transfers and cash transactions.

FreshBooks

Founded in Toronto in 2003, FreshBooks is one of the stalwarts of accounting software and looks unlikely to go anywhere soon. The company boasts 24 million users and an average of 192 hours saved annually by using its software.

Designed specifically for small businesses, FreshBooks manages invoicing, expenses, time tracking and payments. PayPal and MailChimp integrate seamlessly.

FreshBooks is entirely cloud-based, so accessing accounts from multiple devices and locations is a cinch. It also means that your data is automatically backed up, should anything happen to your device.

How small is a small business, exactly? FreshBooks’ Lite tier manages up to five clients for $15 a month, while the Premium tier covers up to 500 at $50 a month. Beyond that, FreshBooks Select has your back – it’s designed for businesses that turn over $150,000 a year or more.

Xero

Kiwi software company Xero arrived in London in 2008 and has since cemented itself as one of the giants of the British bookkeeping market. Globally it boasts an impressive 1.58 million users and additional offices in Australia, the United States, Canada, Asia and South Africa.

Aimed at small businesses, Xero covers invoices, payroll and expense reports, in addition to tracking inventory and creating purchase orders. Over 700 third-party apps connect with Xero, many of which cover invoicing, time tracking, e-commerce and payments in depth; others cater to specific sectors such as agriculture, non-profit and hospitality.

Pricing starts at £10 per month for the Starter tier, with payroll and expenses sold as optional extras.

FreeAgent

FreeAgent is designed for micro businesses and freelancers without accounting experience. Its web interface is clean, intuitive and works in tandem with its iPhone and Android apps for a fully online experience. Features include invoicing, expenses, automatic tax forecasts, payment reminders and time tracking. If you’d rather not do it all yourself, it’s simple to invite an accountant to work on your books. FreeAgent also provides a directory of trusted partners.

One area where FreeAgent really excels is customer support; its Edinburgh-based team of accountants is reachable by phone, email and chat and all have hands-on experience with the software and its competitors.

Pricing starts at £9.50 per month for sole traders, with plans available for partnerships and limited companies.

Zoho Books

Zoho’s suite includes software for customer relationship management (CRM), email, inventory, analytics and human resources, making its accounting software particularly tempting to business owners in search of a streamlined yet comprehensive approach. With more than 40 specialised programmes, you can cherrypick the combination that suits you or opt for one of Zoho’s bundles.

The downside is that Zoho Books as a single program covers far less ground than its competitors. Where other bookkeeping suites offer invoice building and tracking, you’ll have to buy into Zoho Invoices; inventory is another product you’ll need to splash out for. Zoho Books covers cash flow, income and expenses, VAT filing and time tracking.

Prices start at £6 per month for the Basic tier.

Clear Books

Cloud accounting software Clear Books offers three price points for small businesses and integrates flawlessly with PayPal, GoCardless and PayPoint.

Business owners looking for a bare-bones accounts system on a budget will appreciate Clear Books Micro. The free software matches income and outgoings to bank transactions and looks just like a spreadsheet.

More established businesses can spring for richly featured online software that covers invoices and quotes, reports, dividends, VAT and multiple currencies; the Small package costs £10 per month, while the unlimited Large package is £21.50 monthly.

KashFlow

London-based KashFlow is another web-based contender for small business accounting and payroll and places an emphasis on intuitive features and reports that are easy to understand.

Where KashFlow really stands out is its specialist Healthcare suite for GPs, surgeries and healthcare professionals; it adds specially tailored features and functionality to its existing accountancy, payroll and HR software for British practices looking to move to the cloud.

Pricing begins at £8 per month for the Starter tier, recommended for sole traders and contractors. Limited companies can expect to pay £15 per month, with payroll available as an added extra.

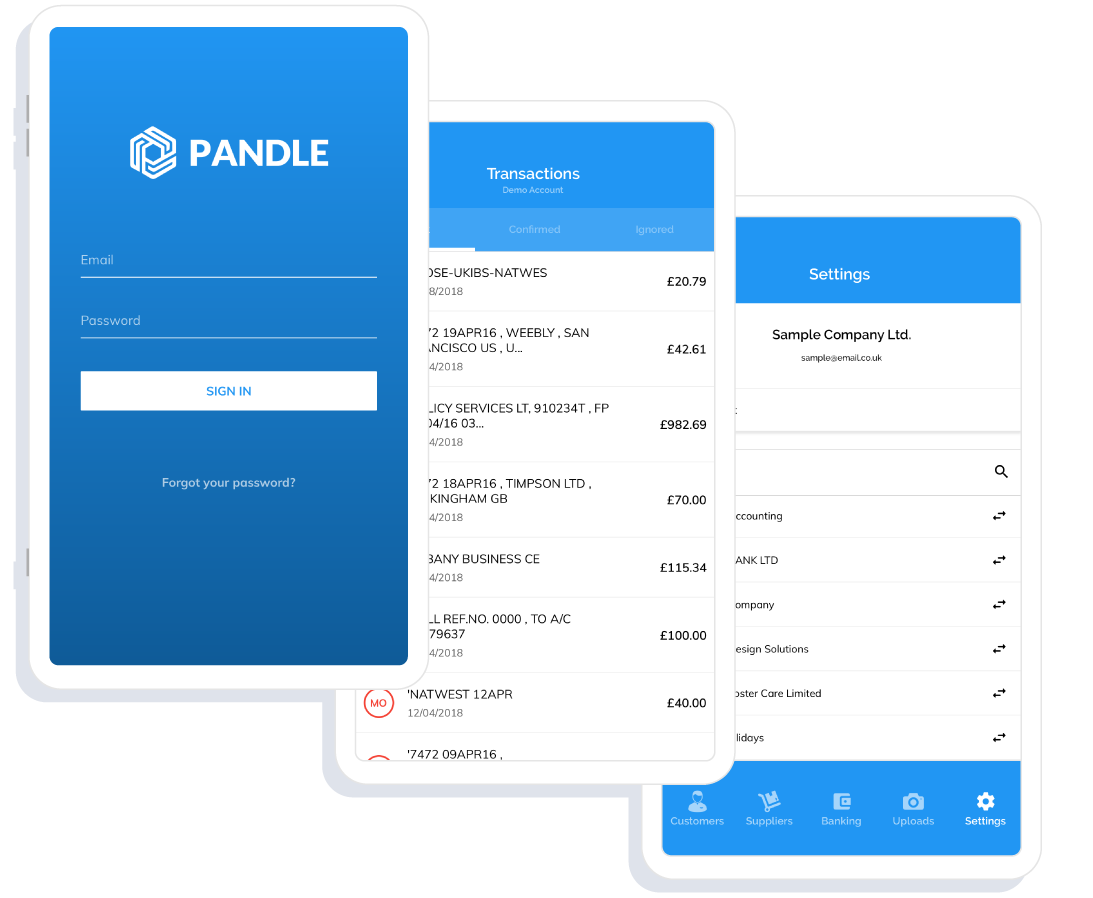

Pandle

Another great choice for businesses on a budget, Pandle‘s basic service is free and includes invoice creation, multiple currencies and a mobile app. Its free features are surprisingly comprehensive and include payment reminders, VAT submissions and business reports. As it’s integrated with HMRC you can send returns directly from Pandle, rather than copying data over.

Pandle Pro costs £5 per month and includes receipt uploads and cash flow forecasting.

What is Accounting Software and Why Should I Use It?

Accounting software is a digital solution that helps businesses to better manage their books. This type of software can help people to save hours on a range different accounting tasks by automating them. Accounting software can manage invoicing, expenses, payroll and more, however its capabilities will vary depending on the software you choose.

Accounting software can be incredibly beneficial to a business, helping to simplify the accounting process and improve efficiency. Using this type of software can automate many of time-consuming tasks that come with running the books. It can free up your time to be spent on other projects, and improve productivity throughout a business.

How Much Does Accounting Software Cost?

Accounting software will vary in cost, however, based from our top 10 list, you could pay anything from £5 to £21.50 per month. Costs for accounting software vary due to different software products offering various different accounting services. For example, FreshBooks can manage five clients at a rate of $15 per month, whilst QuickBooks prices begin at £8 per month for self-employed business owners. These two companies both offer accounting software services, however their products will vary in a range of different ways.

As the services offered will vary between providers, it’s important to establish what you want from your accounting software, and explore as many options as you can to find the optimal choice for your business.