Employee life insurance has become an increasingly popular employee benefit for organisations and something that is being offered more and more to staff as a way of increasing loyalty and retention.

In a world where people change jobs more frequently than ever before, companies are always looking for ways to incentivise and keep staff – and offering life insurance as part of the employee agreement is something that is almost becoming a standard and highly sought-after benefit.

We speak to yulife, one of the leaders in the space for employee life insurance to find our more about the product and its benefits.

What is Employee Life Insurance?

Employee life insurance is an insurance policy for your employees and it pays a lump sum to the closest family members of the employee in the unfortunate event of their death.

Life insurance pays out a large sum to the closest beneficiaries of the deceased, such as the spouse or children and offers an income replacement to cover things like their rent, mortgage payments, children’s education and basic necessities such as clothing and food.

As a rule, the pay-out will give up to 20x the employee’s salary and this is seen a huge benefit to employees which is covered by their employer as a ‘benefit in kind.’

At yulife, the cost is £4.99 per person, per month and covered by insurance provider AIG – and you have the choice to cover all or certain staff members, whether you have 2 members of staff or 200.

What Do You Get With Employee Life Insurance Cover?

Employee life insurance will typically come with a number of perks and cross-over with employee health insurance, including:

- Access to Doctor on Demand services

- 24/7 virtual GP

- Prescription for members and their families.

Check your provider to see what benefits are available – this may often include things like cinema tickets and childcare vouchers.

At yulife there are a number of rewards for people that complete tasks for good health and mental wellbeing.

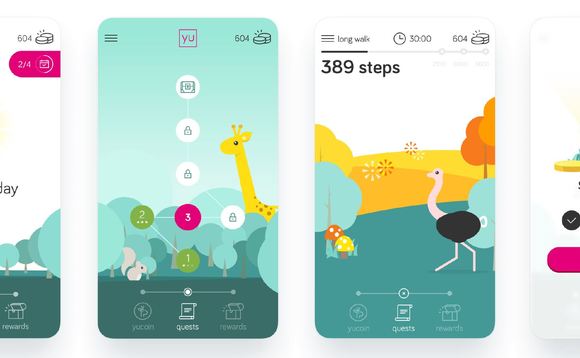

When you download yulife’s app, it will give you rewards for every mile you walk and additional activities such as meditation and breathing – all in the form of yucoin, the brand’s wellness currency. The more yucoin you accumulate, the more discounts, vouchers and freebies you can unlock from the likes of ASOS, Amazon, EAT and more.

What Are The Benefits of Employee Life Insurance?

Employee Retention – For staff members, employee life cover is seen as a huge benefit and also a saving from buying their own life insurance. Only 30% of people in the UK have any kind of life insurance in place, so for some, it will offer a very important form of financial cover.

For many workers that feel like a means to an end, having life insurance provided by their employer shows that they care about their financial and mental wellbeing – and are interested in safeguarding their financial future. Any benefits or perks can go a long way to retain staff, building a long-term relationship with their employer and avoid them leaving the organisation.

The cost of replacing or recruiting key staff can be a long and costly process – so keeping the same staff happy and invested is very valuable and limits disruption.

Free of Charge for Employees – Life insurance for employees is usually given to workers for free, as a benefit in kind from the employer. The average life insurance policy in the UK is around £30 and this can be even higher if you are a smoker or over the age of 50.

There is no downside for employees or cost implications, regardless of their current health position or age. Whether you are 25 or 60 years old, it is still covered by your employer, even though someone older would typically pay a lot more for a premium.

Tax Deductible for Businesses – There are tax benefits for employees when they provide life insurance (and health insurance) for their staff. This makes purchasing cover a potentially cost saving exercise and it is something can reward and incentives staff members, which can help boost productivity.

Are There Medicals Required?

When purchasing employee life cover in bulk, it is not subject to individual medicals – whereas an individual may usually involve this and a requirement of medical history.

For yulife, companies can sign up employees on the same day and fast-track through the process by not needing to provide any medical history. So far, 100% of claims have been approved in the last 2 years.

How Many Staff Can You Insure Under The Same Policy?

You will usually need a minimum of 2 people in your organisation to be eligible for employee life insurance. However, plans from yulife can cover up to 10, 50, 200 or 500 staff members under the same policy and provide one set of documentation and online admin so it is easy to manage.

Staff can log in any time for information about their policy or to submit a claim.

The insurers benefit from being able to insure multiple people under one policy – and this is why policies at £4.99 per person, per month are extremely competitive.