Are you struggling to find a mobile credit card payment terminal? With so many different options out there offering attractive deals, it can be tricky to find the credit card machine that’s best for your business.

Best Credit Card Machines UK

Depending on what size your business is and what your monthly turnover is, we have put together a list of our top 10 credit card terminals and credit card machines to help you decide which option is best for your business.

So, without further ado, here is our list of the best credit card machines UK businesses should consider, all with varying different features to explore:

1) SumUp

Key Features include:

- Card reader = £29+VAT

- Per transaction = 1.69%

- For small businesses, sole traders and entrepreneurs

- Works entirely online

- No fixed monthly costs

- No contract

The Machine

SumUp provide a mobile card reader for businesses that need to accept card payments on the go. The machine accepts contactless, Chip and Pin and Apple and Android Pay, as well as all major credit and debit cards. Additionally, payments are accepted via smartphone and tablet. Overall, the machine connects through Bluetooth and is compatible with Apple and Android phones and tablets.

Why you should choose SumUp

SumUp should be chosen if businesses process low volumes of card transactions because there is a transaction fee. Transactions should be processes within 2 to 3 days which can be viewed through the free app available on iOS and Android. There are three different options to choose for including the first which is the Square Stand, second is the Square Terminal and the third is the Square Reader. Square offer 30 day money back guarantee as well as a 1 year hardware warranty.

2) Square

Key Features include:

- Card reader = £19+VAT

- Per transaction = 1.75-2.5%

- Hardware warranty = 1 year

- For businesses of all sizes

- Used to sell online, by phone and collect payments through invoices

- No minimum transaction value

The Machine

The pocketable mobile card machine accepts contactless and Chip and Pin payments along with Apple Pay, Android Pay and Samsung Pay. It connects wireless to Android and iOS devices allowing payments to be accepted using the Square app which is free to download.

Why you should choose Square

Square covers everything, from sales reports to viewing all transactions and deposits. Square also gives you the option to save cards on file. Additionally, payments are received within 3 to 5 business days or within 20 minutes if you pay to upgrade to instant deposits.

The company has a monthly rental cost of 0-£29, and has a 30 day money back guarantee. Square also offers add ons. These include:

-

- Square Terminal – an all-in-one device which allows businesses to take payments and print receipts from one machine

- App access to inventory management

- Software for invoicing allowing online card payments

- Sell online with Square’s Ecommerce API

- App access to track employee performance

3) Barclaycard Anywhere

- Card reader = £29+VAT

- Per transaction = 1.60%

- No monthly fees

- Connect over Wi-Fi or 3G or higher

The Machine

The machine accepts contactless as well as Chip and Pin payments from Visa and MasterCard payments, however it does not take Amex. You can connect your smartphone to the card machine using Bluetooth allowing payments and refunds to be made.

Why you should choose Barclaycard Anywhere

Barclaycard Anywhere is a fantastic addition to our list of mobile credit card terminals UK businesses should know about. It has an Android and iPhone app which allows businesses to track payments on the move and in real-time.

Once logging into the App with your username and password, the app will display a New Sale Screen where you can enter the amount of the sale and then press checkout. This will allow the card machine to wake up and display the amount of the sale for the customer to see and then they can tap or inset their debit or credit card. A receipt can then be sent over email to the customer, if wanted.

4) Shopify

- Card reader = $29+VAT

- Per transaction = 1.5-1.7%

- No monthly rental cost

- For businesses who want to accept face-to-face payments

The Machine

Shopify’s machine accepts chip and contactless cards, including Visa, MasterCard and Apple Pay. It allows a business to accept two or more payment types in a single transaction as well as create custom payment options such as cheques. At the end of the transaction, a custom email or printed receipt will be given.

Why you should choose Shopfiy

Shopify is chosen by businesses who want to accept face-to-face payments. For a smooth checkout, Shopify machines will accept payments anywhere, whilst keeping payment information safe and storing all past orders made in store and online by searching for a customer, product or date. An additional attraction to Shopify is that taxes are automatically calculated based on the location of the store.

5) myPOS

- Card reader = £29 VAT – £299 VAT

- Per transaction = 1.75%

- Eco-friendly

- Paper-free

- Colourful LCD display

- 1 year warranty

- 30 day money back guarantee

The Machine

myPOS machine battery is powerful with all machines being contactless and accepts Chip and Pin payments from all debit and credit cards. The machine is eco-friendly, sending electronic receipts to customers via email or text. The machine has constant wireless connection via 3G, making the machine reliable for almost any business.

Why you should choose myPOS

myPOS allows businesses to own a pocket-sized machine which accepts payments and adds them to your myPOS merchant account. Add-ons include:

-

- Multi-currency accounts with free IBAN

- Access to funds from all channels instantly

- myPOS Business Debit Card

- Customised silicon cases

- Charging docks (such as a dock to charge 5 machines)

- Car chargers

- Backup power chargers

- Privacy screens

6) iZettle

- Card reader = £19+VAT

- Per transaction = 1.75%

- Hardware warranty = 1 year

- Ideal for small businesses

- Contactless payments are up to 25% faster than other mobile credit card terminals

- Money deposited in your bank within 1-2 business days

- Send receipt via SMS or Email

The Machine

The first in our exploration of the top mobile credit card terminals UK businesses should know about – iZettle supports contactless and Chip and Pin payments from all major card providers as well as payments through Apple Pay, Android Pay and Samsung Pay. When contactless payment is used, transactions below £30 are approved within seconds. The device connects through Bluetooth which works alongside the iZettle App.

Overall, the machine quickly boots up within 2 seconds, processes payments in 5 seconds or less and you get roughly 8 hours of active use from a single charge processing 100 transactions. The machine charges through the dock or USB cable and should take 1-2 hours to fully charge.

Why you should choose iZettle

The card reader starts off as low as £19+VAT with 0-£29 monthly costs. Additional add-ons are available, allowing you to purchase stands and docks, receipt printers, barcode scanners, cash drawer and store kits.

7) Ingenico Group

- Per transaction = 1.4-3.5%

- 12 month contract

- Pricing package tailored around your business

- For all businesses no matter what size

The Machine

Ingenico Group offers portable terminals, desktop devices, mobile terminals for different businesses. All major credit and debit cards accepted as well as contactless. The card machine is portable which means it can be taken to your customers and works via Bluetooth of WiFi. The battery is long lasting, lasting all day.

Why you should choose Ingenico Group

Ingenico Group card machines are easy to use and are portable. The machine can take transactions anywhere in the UK meaning you are always connected. Ingenico offers various products for businesses including starter, premium and enterprises plans which vary in cost.

8) SimplyPayMe

- No card reader needed

- Per transaction = 1.75-2.15%

- Payments accepted via email, face-to-face and over the phone

- 30 day free trial

Why you should choose SimplyPayMe

With SmartTrade, a simple download of the mobile app is needed to then turn your smartphone into a portable payment machine, and is available on Android, iOS, Mac and PC. Amex, MasterCard and Visa payments are supported with payments taking 5 business days to clear. However, this can be reduced to 3 days if a business turnover is over £30K per month. Using SmartTrade, your business is guaranteed to be secured by encrypted technology, with professional customised invoices and paperless quotes for customers which can be accepted with one click. After 30 days, the service has three plans to pick from, these include:

-

- Sole Trader: 1 user and 2.15% + 20p fee – £9.99/Month (£101.90/Year)

- Business: Up to 15 users and 1.85% + 20p fee – £26.99/Month (£275.30/Year)

- Enterprise: Up to 50 users and 1.75% + 20p card fee – £89.99/Month (£917.90/Year)

9) PayPal Here

- Card reader = £45+VAT

- Per transaction = 1-2.75%

- A trusted name

- Accept face-to-face payments anywhere

The Machine

PayPal Here accepts all major card companies, as well as Apple and Android Pay. Payments made are received in your PayPal account within seconds but withdrawals cannot be made for 3 to 5 business days.

By charging the machine using a USB cable, it should last for 7 days on standby or for 100 transactions.

Why you should choose PayPal Here

PayPay Here charge no termination fee, and have no monthly rental costs. With up to 200 users on one account, cards can be tapped, swiped or entered manually allowing for many payments to be made.

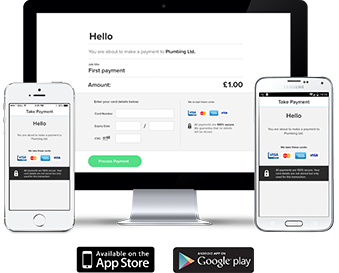

10) takepayments

- 12 month contract

- Next day settlement

- Payment by email, online, phone or SMS

The Machine

The card machine connected through bluetooth and making is portable. It accepts phone payments, contactless, and all major credit and debit cards. The battery on the card machine should last all day and should either be plugged directly into your phone line or broadband or through your Wifi. Moreover, the machine is lightweight, can connect by broadband or phone and can print receipts quickly.

Why you should choose takepayments

Takepayments does not ask for a set up or exit fee making it an attractive option for small business, as well as those that are larger. Invoices can be sent and payment can be received over email, with money taking 3 to 5 business days to come into your business account. Takepayments work with you to find the best deal for your business, understand how you work and what package would fit your business’ needs.

What is a Credit Card Terminal?

Credit card terminals are electronic handheld devices used by businesses to process credit or debit card payments electronically at the point of sale. There are three main types of credit card terminals including countertop, mobile and portable. As more and more people are paying with credit or debit cards, an increased number of consumers expect the option to pay with a card if they want, wherever they go. On the whole, credit card terminals have made payments easier, quicker and more secure.

How Do Credit Card Terminals Work?

The purpose of these credit card terminals is to scan the card, authenticate the card and transmit the data. This protects the merchant because it allows payments made with stolen or damaged cards to be denied.

Most credit card terminals will have a keypad and a slot to insert or swipe a customers credit or debit card. After the card is inserted or swiped, the terminal will read the information on the card’s magnetic strip.

Many credit card terminals require a unique four digit code to be keyed in as an additional security measure, however this is not always the case as contactless payment are becoming more common allowing customers to tap their card or phone with their Apple Pay, Android Pay and Samsung Pay. The information from the card’s magnetic strip is then sent for verification, which will send either an “approved” or “denied” message on the terminal. If the card is approved, the customer can take home their good, for example, but if the card declined, they have to either provide another credit or debit card or return the good.

Credit card terminals are either attached to phone networks or are wireless where data is sent over WiFi. This enables data to be transmitted to allow for credit or debit cards to be verified. This happens in a matter of seconds allowing businesses to provide fast checkouts and payments to occur ensuring that many customers can be welcomed into a store or restaurant, for example.

How Many Do You Need?

The number of credit card terminals is dependent on the size of a business. Small business may only need one credit card terminal, however larger businesses may need dozens.

The Best Mobile Credit Card Terminals UK Businesses Should Consider

Through this guide, we’ve listed some of the top mobile credit card terminals UK businesses should consider. It’s important to note that there’s no one credit card terminal best for all businesses, and the one right for you will depend upon the nature of your operations, and what you’re looking for in a credit card terminal provider.

When setting out in search of a new provider, it’s good to firstly lay out the type of terminal you want for your business, including the payment types you’d like it to accept, whether you’d like to test the service with a free trial, and how long contracts last. Once you’ve established exactly what you want from your credit card terminal/machine provider, you’ll make it easier to sift through viable options, and streamline the process of finding the right one for your business.