Have you heard about umbrella companies, but not entirely sure how they work in practice or have fairly little understanding as to who they are for and what their benefits are? TechRound takes a closer look at what exactly is meant by an umbrella company.

What Is an Umbrella Company?

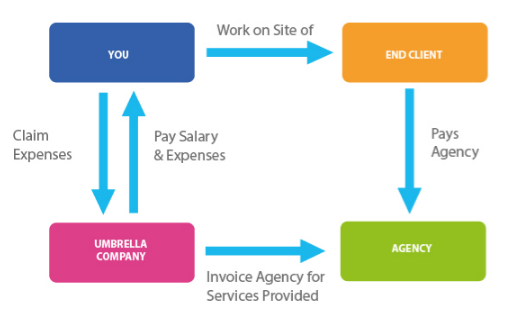

In summary, an umbrella company is considered the main alternative to creating your own limited company as a contractor, with the main responsibility of the umbrella company helping you to organise getting paid for work that you carry out as they act as the middleman between the client (ie. the agency or company you are employed by) and the contractor.

Wondering what makes umbrella companies different to operating through your own limited company? It all comes down to your employment status.

If you run under a limited company, you have a number of benefits that you are able to take advantage of as the director (for example, the opportunities for tax relief) however, this does also entail having to take full responsibility for all your finances.

Whereas with an umbrella company, as you are an employee (meaning that you are also eligible for National Insurance and PAYE contributions) the umbrella company carries out the majority of the paperwork and administrative duties that need to be done on your behalf. Whilst you are an employee of an umbrella company completing a number of different, temporary contracts, you will not need to manage your own payroll.

Who Are Umbrella Companies For?

Umbrella companies usually specifically employ contractors as well as freelancers who are employed through recruitment agencies.

How Does an Umbrella Company Work?

If you decide to work for a PAYE umbrella company, this is the process you can expect to follow:

- When you become an employee of a PAYE umbrella company, you will need to instruct them on a weekly or monthly basis to invoice the agency or client you are working directly for based upon your timesheet (where you will usually be required to log in all your hours, which is then also countersigned by the client)

- The client then settles the invoice directly to the umbrella company, and at this point you then receive the salary from the PAYE umbrella company

- You will receive your net salary, minus any contributions that need to be taken off (such as income tax on your earnings and national insurance)

- You will also be provided with a payslip from the umbrella company, where it clearly states exactly how your pay has been calculated and what has been deducted

Why Are Umbrella Companies Needed?

There are different reasons as to why umbrella companies are needed. For example, as a contractor, you aren’t employed directly by the client or recruitment agency, but you will need a way to pay your taxes and receive money into your account, which is where umbrella companies become extremely useful.

As you are employed by the umbrella company they liaise with the client or recruiter under a business to business contract. Furthermore, as they operate under PAYE, meaning they are legally obligated to pay HMRC for employer’s national insurance contributions.

What Are the Benefits of Umbrella Companies?

There are a variety of advantages involved when it comes to deciding to operate under an umbrella company. These include:

- You are entitled to take holiday pay, which may be difficult if you were the director of your own limited company

- In certain cases, you may also be able to claim for work-related expenses. This means that these would be free of national insurance and tax deductions. Remember that if this is something that you are able to do, you will need to make sure that you keep all your receipts, as these will be needed at a later date in order to make a claim to HM Revenue & Customs.

- You could also be entitled to a companies workplace pension scheme

- It can be an incredibly convenient way to get paid as a freelancer or contractor compared to setting up a limited company, as the umbrella company sorts out the paperwork on your behalf, making the process easy and far less time-consuming for you, enabling you to get on with the work that you need to

- You won’t need to calculate your own tax. This is because the umbrella company deducts all national insurance and tax contributions from your salary prior to you receiving it, meaning that you have one less thing to think about

- Umbrella companies can be beneficial to contractors, regardless of their salary rates

- They can be used by freelancers and contractors on either long or short-term contracts