Company: YuLife

Founder(s): Jaco Oosthuizen, Jonathan Roomer, Josh Hart, Sam Fromson, Sammy Rubin

Website: yulife.com

Description: YuLife is the world’s first life insurance company that inspires life.

YuLife was founded in 2016 to fundamentally transform the life insurance industry in the UK, using technology to switch the focus of life insurance from death to life itself, and turning insurance into a win-win commodity which benefits both insurers and policyholders in equal measure.

The life insurance market has traditionally been characterised by low levels of customer engagement, which is underpinned by the fact that the industry has undergone no fundamental changes since the 1960s, when higher premiums were added for smokers. Policyholders acquire life insurance policies to safeguard their loved ones in the event of unexpected circumstances, but typically lack day-to-day interaction with their insurer. As a result, sign-up rates were declining, as people perceived policies to bring limited ongoing value. YuLife transforms that model by incentivising positive behavioural change on a daily basis, thus making life insurance a product that makes a clear and tangible difference to policyholders’ health and wellbeing.

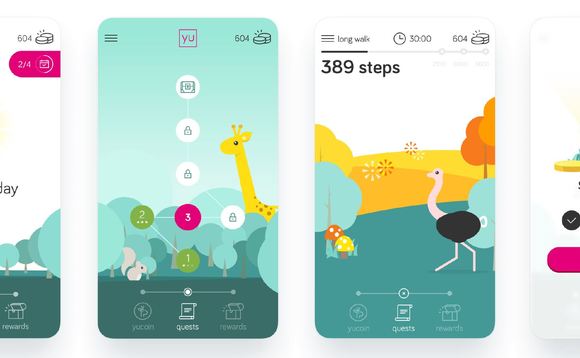

The cornerstone of YuLife’s offering relies on harnessing the latest gamification and AI principles and cutting-edge data science specialists to create an engaging, tech-based life insurance product to suit the modern consumer who is used to having all services available at the swipe of a smartphone screen.

For example, YuLife policyholders are automatically equipped with the game-like YuLife app, which enables users to participate in daily wellbeing challenges, duels, and quests, encompassing walking, cycling, mindfulness and meditation, to earn discounts and vouchers from the UK’s leading brands, such as Amazon, Avios, Marks & Spencer and more. By rewarding individuals for positive behavioral choices, YuLife uses insurance as means to incentivize healthy living. Not only does this improve policyholders’ lifestyles, it also benefits insurers as improved health reduces risk for them.

Tackling widespread lack of engagement, YuLife’s user-friendly package increases the average number of touchpoints per year from 2 to around 120. And with an EY survey in July 2020 finding that some 34 per cent of consumers think that life insurance policies are ‘confusing’, YuLife reduces paperwork and bureaucracy by enabling businesses to sign up their employees online in a matter of minutes. This is especially advantageous for smaller businesses, who typically do not provide group life insurance to their staff. What’s more, the AI-driven insights generated from the YuLife app use can be anonymously fed back to employers, enabling them to tailor their wellbeing offerings dynamically according to indicators of stress and physical activity levels.

YuLife has raised a total of £13M, including £10M in a Series A Round in May 2019 and £3M in a Seed Round in November 2018. YuLife has announced numerous strategic partnerships over the past year, most recently with advertising and communications business Havas Group UK, which has rolled out YuLife’s life and wellness insurance policies across each of its 2,200 employers following a robust trial involving 5% of staff. The company is set for an exciting spree of announcements in the coming twelve months.