Launched in the UK last month, ikigai is an entirely new banking and wealth management offering for people wanting to do more with their money – allowing them to spend, save and invest well.

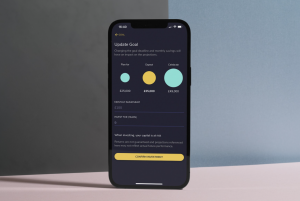

Accessed with a premium ikigai card and beautifully designed app, ikigai is the first fintech in the UK to combine an everyday current account, a savings account, and wealth management services all in one app. Built around the preface of ‘financial wellbeing’, our app allows customers to split their money into their accounts, and invest in portfolios carefully curated by ikigai. Each customer also gains access to a personal relationship manager, to ensure an entirely personal experience.

Compared to other digital banking platforms, ikigai is a service built for the young and newly affluent – a demographic of people now entering their prime earning and spending years, who want to do more with their money but have specific financial needs that may be too complex for everyday banking services.

How did you come up with the idea for ikigai?

The idea for ikigai came about after realising we both shared the same frustrations with our banking services. As consumers, we never felt that we had a banking relationship we valued nor one that valued us as customers. We also realised that there is a huge disconnect between the low-touch, everyday services that high-street banks offer to consumers, and the high-engagement, personalised experiences private banks provide to their most wealthy clients.

From here we knew there was a need to build a service for people like ourselves who were looking for something different to their everyday banking app, and so Ikigai was born. Coming from the Japanese meaning ‘The reason of being’, we believed that individuals coming into their best years of earning potential would want their money working for them more efficiently and productively, all while having a personal point of contact.

ikigai has been developed to meet a client’s needs in a more intimate way than the average bank, combining the best mix of a high-touch, personal service you would find in private banking with the seamless user experience of a fintech.

More from Interviews

- A Chat with Dr. Stuart Grant, Founder and Principal Consultant at Archetype and Judge in the MedTech38 2025

- Interview With Raman Alsheuski, VP of Product at AIBY

- Meet Greg Squibbs, Founder of AI Agency Training Hub: StartYourAIAgency.com

- Meet Eamon and Arj, Co-Founders Of Tax Return Platform: Taxd

- Interactive Fun and Entertainment: Meet Jonny Powell, CEO of 501 Fun

- Meet Jaron Soh, Co-founder & CEO of LGBTQIA+ Mental Wellness App: Voda

- Meet Nathalie Morrison: The Founder Behind Astrea, the Fashion-Tech Brand Putting Lab-Grown Diamonds at the Heart of Luxury

- Meet Badr Ward, CEO And Founder Of Education Platform: Lamsa

How has ikigai evolved during the pandemic?

Having only launched ikigai officially in March, the past year has seen us steadily building our product and service into something we know our customers will love.

If anything the pandemic has only made us realise more the importance and demand for a product such as ikigai. As Covid-19 has disrupted people’s lifestyles and livelihoods, the need to maintain financial stability and wellbeing has never been more important than before and people want an easy way to manage their finances. On top of this, as lockdown has forced us to distance ourselves from others, and limited social interactions, we also believe that our high-touch relationship managers will be a welcome addition for our customers wanting to build a connection with their money and wealth.

What can we hope to see from ikigai in the future?

We are still just at the beginning of our journey with ikigai, and are incredibly excited to see where this will take us next. Having just recently completed a crowdfunding campaign in April, which saw us raise over £1.2m, reaching overfunding in 12 hours, our immediate priorities will be focused around further accelerating our product, building our tech team and hiring new relationship managers.

Beyond this, we’re incredibly grateful for how well ikigai has been received so far, and are passionate about keeping this momentum going. Our product roadmap has seen us recently launch a new stocks & shares ISA for our Wealth service, and we already have many more developments in the pipeline that we’re excited to reveal over the coming year.