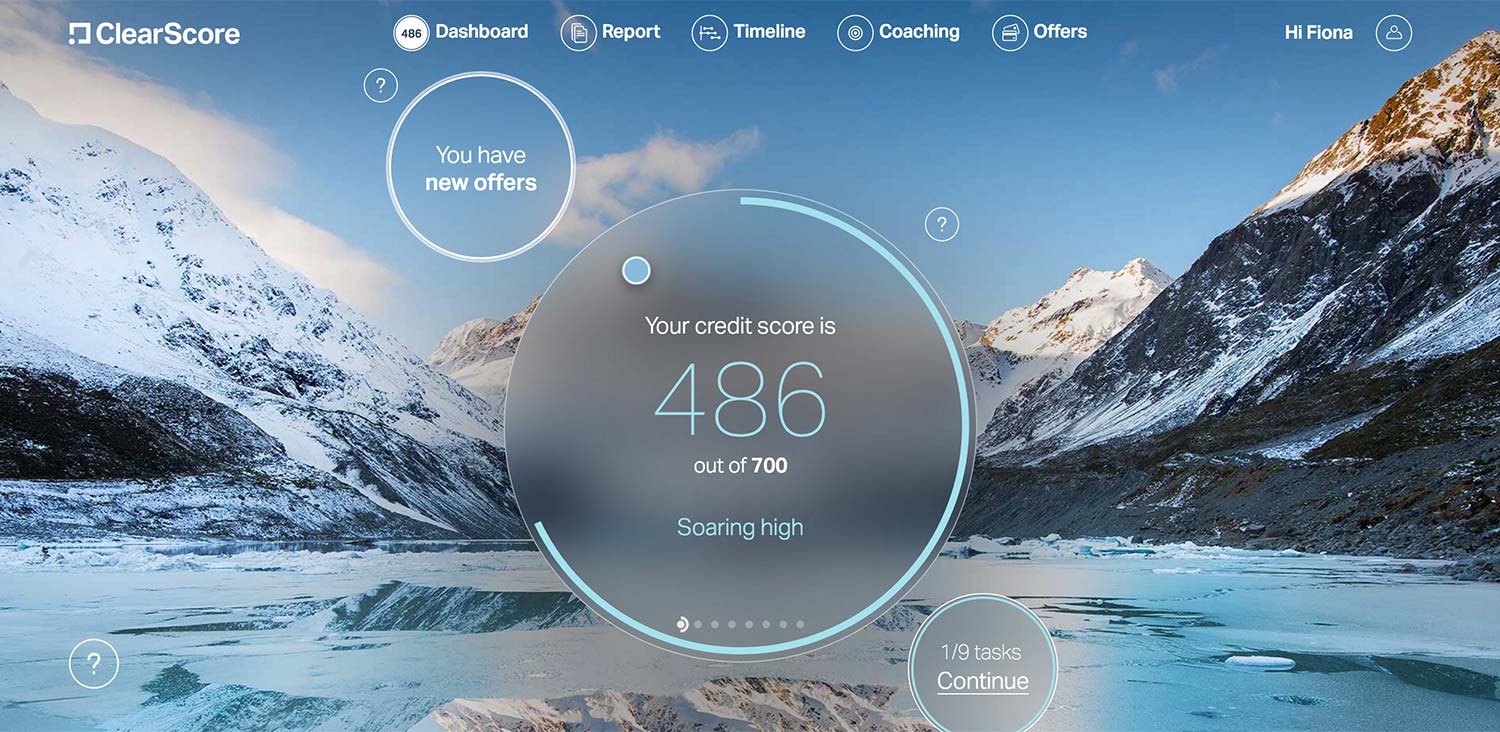

Clearscore is a business dedicated to helping users improve their financial wellbeing, with a vision to help everyone – no matter what their circumstances are, achieve this goal. We started this journey by giving everybody access to their credit score and report for free, forever.

By combining a brand that people trust, a product that is beautiful to use, amazing technology and deep analytics, we deliver a unique experience that helps people take control of their financial future.

How did you come up with the idea for the company?

In many ways, ClearScore is the culmination of the experiences I’ve had throughout my career. I’ve had a number of different roles – from my early days in consumer goods at P&G, to my roles in marketing and financial services at Capital One – and all of them have had an influence on my thinking. However, it was really when I started my journey as an entrepreneur that those experiences came together with my desire to empower consumers – particularly when it comes to helping people to access and benefit from their own data.

Too often consumer data has been exploited against their best interests – so with ClearScore, we’re on a mission to positively impact the lives of our users. Achieving that mission isn’t just about building something that matters for our users and putting people’s data to work for their benefit. It’s also about understanding that our own people matter too – and building an inclusive culture where everyone, regardless of their background, can reach their full potential.

More from Interviews

- Meet Jaron Soh, Co-founder & CEO of LGBTQIA+ Mental Wellness App: Voda

- Meet Nathalie Morrison: The Founder Behind Astrea, the Fashion-Tech Brand Putting Lab-Grown Diamonds at the Heart of Luxury

- Meet Badr Ward, CEO And Founder Of Education Platform: Lamsa

- A Conversation with Andrej Persolja, Founder of We Fix Boring

- A Chat with Kebbie Sebastian, CEO and Founder of Merge

- Meet Dr Agnès Leroy, GPU Director at Cryptography Tool: Zama

- Meet Roman Eloshvili, Founder of ComplyControl

- Inside Mobile Payments with Bojoko’s Ville Saari

What advice would you give to other aspiring entrepeneurs?

Most start-ups inevitably fail – it’s a simple fact. What’s important, however, is recognising the possibility of failure and learning from it. Any new venture is, first and foremost, a learning experience.

It’s ok to fail, in fact, it can be necessary – so much so that ‘Failing and Fixing Fast’ is one of our core principles at ClearScore. If you are learning, working with people you like and enjoying the journey along the way, you’re probably on the path to success.

What can we hope to see from ClearScore in the future?

ClearScore has been on a whirlwind journey so far – in five short years, we’ve helped over 12 million people in three countries around the world get on the path to greater financial confidence.

But we’re not stopping there. Our focus now is evolving and diversifying our technology to help more people get on in life – whatever their financial goal may be.

A key opportunity is open banking. The potential of open banking has been emphasised by COVID-19. One of the less publicised knock-on effects of the pandemic has been a large-scale withdrawal of credit from the market, precisely at the time when many people need it most. Our own research shows that UK consumers have seen an average 59% reduction in available credit offers across credit cards and loans, with self-employed and part-time workers (among them key workers) hardest hit.

Facing this unprecedented financial uncertainty, open banking has the potential to usher in a new era of consumer-focused lending that treats consumers as individuals, taking into account someone’s specific financial needs, rather than applying traditional credit-lending models to vast numbers of people. These services are increasingly in demand from lenders and consumers alike and are investing heavily in our open banking capabilities as a result.

Alongside open banking, we simply can’t ignore the fact that during the pandemic we have seen a significant uptick in fraud. Our own research shows that 55% of UK consumers are more worried about online fraud now than they were before the coronavirus pandemic.

Having fallen victim to identity theft myself, I understand how it can impact a person’s financial and mental well-being. It’s why we’ve already launched ClearScore Protect, a free service that monitors the dark web for stolen passwords and alerts users to any potential breaches.

But the issue doesn’t end there. We feel a major responsibility to our users to be proactive when it comes to cyber security and data protection. Whereas awareness of data security threats may be on the rise among consumers, we are focused on going further and helping people to take action to protect themselves.