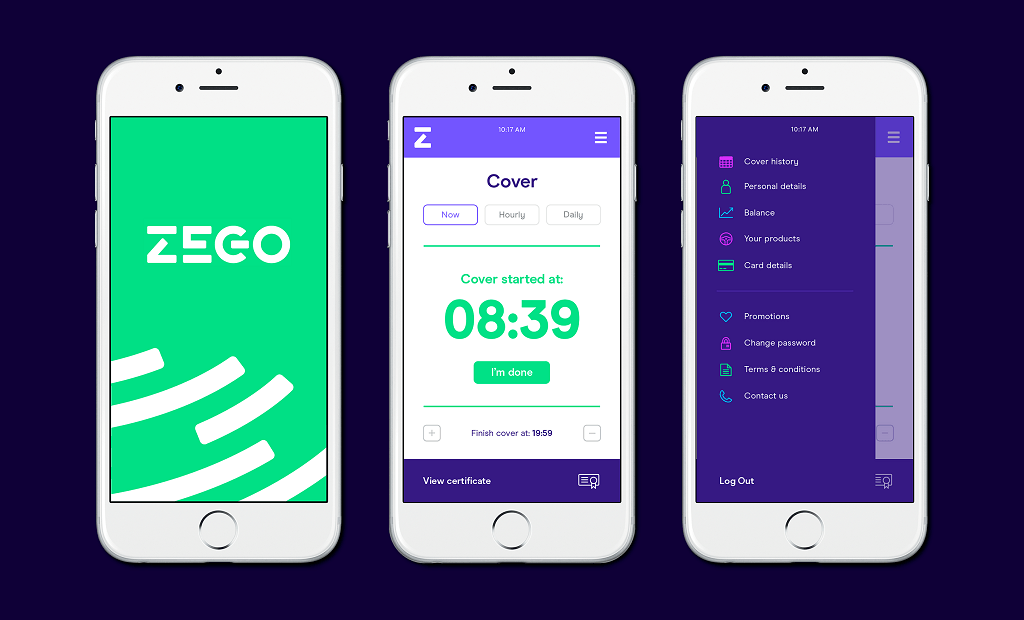

Zego is a ‘new mobility’ insurance provider, powering opportunities for people and businesses who use vehicles to earn money, allowing them to reach their full potential. We currently insure over a third of the UK’s food delivery market and have provided over 14 million policies to our customers.

We also partner with a large number of fleet businesses, such as car-sharing, car leasing and more recently, e-scooter companies like Voi and TIER, as well as provide pay-as-you-go insurance to gig economy workers, such as those who drive for Uber and Deliveroo.

We offer a range of policies from by-the-hour insurance to thirty-day cover to annual cover, providing more flexibility than traditional insurance policies. To revolutionise the way that insurance is priced going forward, we recently acquired telematics company, Drivit. This acquisition means that we can understand risk better than anyone else in the market, by making use of not just data gleaned from our technical integrations and more traditional factors such as age and location, but also individual driver behaviour data.

We currently operate in five countries – the UK, Ireland, France, Belgium and Spain.

How did you come up with the idea for the company?

Zego was founded in 2016 by myself and co-founder, Harry Franks. While working together at Deliveroo, we discovered that costly annual insurance premiums were stopping potential workers from entering the gig-economy market, and we wanted to change this. We set out to build a more flexible model that would allow people to start working quickly, without needing to pay for insurance up-front and to only pay for insurance when it was needed.

Since then, we have shifted some of our focus to the B2B insurance market, which has barely evolved for decades. Our flexible usage-based insurance has been invaluable for fleet and new mobility businesses during the pandemic, preventing firms from incurring large insurance costs when their vehicles are off the road, reducing their overheads by thousands.

More from Interviews

- Meet Roman Eloshvili, Founder of ComplyControl

- Inside Mobile Payments with Bojoko’s Ville Saari

- Meet Steve Haskew, Group Director of Sustainability and Growth At Circular Computing

- A Chat with Hakob Astabatsyan, CEO and Co-Founder of Synthflow AI

- Meet Ernesto Suarez, CEO at Travel Insurance Provider: Gigasure

- Under Pressure and On the Clock: Gurhan Kiziloz’s Nexus International to Hit $1.45B Revenue in 2025

- Daisy Ip of InvestHK: Why Hong Kong Continues To Grow In Popularity Amongst UK Fintech Startups

- A Chat with AJ Balance, Chief Product Officer at Grindr

What advice would you give to other aspiring entrepreneurs?

Don’t believe what investors, advisers and other people around you have to say. They all come from their own angle and have their own experiences, so their advice may not be applicable. Your gut instinct is most important, and your duty is to filter what’s going to be helpful and what’s not.

It’s also key to surround yourself with support and that you look after your mental and physical health. I am a real advocate for therapy and wouldn’t be where I am today without it. A huge part of this is also following something you truly love doing and believe in – those who are in it for the right reasons will always come out on top.

What can we hope to see from Zego in the future?

We will be offering a more diverse range of insurance products, with fairer pricing that better reflects drivers’ true risk thanks to the combination of data points that can now draw on, including traditional factors, to technical integration data and driver behavioural data. We will roll these products out across Europe and beyond to help our customers access fairer, more easily accessible insurance wherever they are.