Strive has been set-up to help give parents ways to teach kids about money in a fun and engaging way. Our products are designed to appeal to kids within certain age brackets, so regardless of their age, parents have the tools within Strive to give their children financial skills and confidence for life.

In Strive we are filling up a real gap in the market to build a solution for parents that grows with the child, so it’s not just a debit card, it’s a whole 0-18 proposition that parents can start at any age. There are different functionalities that can separately target and engage young children and teenagers and offer a comfortable, intuitive solution for parents too. For example, parents can start saving for their kids from an early age by saving into our pots, then graduate to Penny the Pig (our interactive money box), and then onto our debit cards.

We also have our own in-house design and development teams enabling us to satisfy all arising client needs. Our scalable team consists of design enthusiasts, best-in-class Android and iOS developers as well as fintech experts. Last but not least, we also provide white label integrations that lets banks in other parts of the world build similar solutions.

We have just announced Strive launch in the UK with the support of London & Partners together with the amazing local fintech community and the waitlist is now open for everyone who wants to be the first to use Strive to make financial literacy fun for the whole family.

How did you come up with the idea for the company?

We’ve been working with a lot of fintech and banking clients over the last years and the idea of a youth focused fintech proposition for families kept coming up. While every bank we talked to was interested in the concept, it was hard to find one that was truly ready to focus the energy and resources needed to build a dedicated offering for families.

Also, also as a founder of the award-winning fintech ff. next – where we provide design-driven mobile banking apps for banks and fintechs with a special focus on kids aged 10 and above – I always had big ambitions but it wasn’t until we met the next generation piggy bank company GoSave during the well-known F10 accelerator programme in Switzerland last year, that I realised that there was a whole segment of the market that hasn’t been served so far: kids aged 10 and under who don’t own a smartphone.

We’ve been waiting for the right partners to put together the first truly family-focused offering with age-appropriate solutions for really young kids, teenagers and also their parents.

We believe that taking control over your finances is a lifetime of work, and starting to learn about financial literacy and how to manage your money is vital from a young age. In order to increase the financial consciousness of youngsters they must be involved in financial services early on, which requires digital solutions, interfaces and in the end – applications which can be used easily and intuitively.

We decided to take this matter in our own hands. The aim of our solution is to provide families with a tool that helps parents teach the basics of financial consciousness for their children in a controlled environment, following the principle of learning-by-doing.

More from Interviews

- Interactive Fun and Entertainment: Interview With 501 Fun

- Meet Jaron Soh, Co-founder & CEO of LGBTQIA+ Mental Wellness App: Voda

- Meet Nathalie Morrison: The Founder Behind Astrea, the Fashion-Tech Brand Putting Lab-Grown Diamonds at the Heart of Luxury

- Meet Badr Ward, CEO And Founder Of Education Platform: Lamsa

- A Conversation with Andrej Persolja, Founder of We Fix Boring

- A Chat with Kebbie Sebastian, CEO and Founder of Merge

- Meet Dr Agnès Leroy, GPU Director at Cryptography Tool: Zama

- Meet Roman Eloshvili, Founder of ComplyControl

How has the need for Strive evolved during the pandemic?

The need for a comprehensive solution such as Strive, to easily create proper money management habits in children, is becoming even more important due to the recent financial instability and uncertainty that accompanied the pandemic and our increasingly cashless economy. When it comes to spending, the prepaid cards for each child allow unique parental control; top ups, online and instore purchases, all with real time notifications and spending rules teach healthy money management habits for kids.

Seeing homeschooling on the rise, there is a visible need for practical, easy solutions to teach youngsters financial literacy effortlessly and at home.

We have a special focus on families who need support to instill good budgeting and saving habits early on to make their kids be better off in their adult lives.

What can we hope to see from Strive in the future?

We can identify two key areas: the questions of product development and long-term vision.

Our already existing, comprehensive offer includes:

- a next generation piggy bank for the 5-10 years old,

- a pocket money application for the 10+ kids,

- customisable Strive prepaid Visa card for teenagers

- and a parent Strive app that gives access to all Strive tools and features, including savings accounts, the interactive piggy bank, chores and pocket money management, goals and rewards marketplace and kids’ own debit cards.

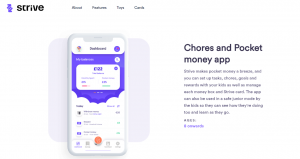

With the help of our solution, parents can set up tasks, chores, joint savings goals and reward their children, so they can learn that money is received in return for work and to budget what they earned, while having fun along the way.

Regarding product development, we plan to incorporate ISA Accounts into our solution too, enabling tax-free savings. Furthermore, we plan to elaborate on separate value propositions for the different age groups of children, including the 0-5, the 5-10 and the 10+ years old youngsters and their parents as well.

As of our long-term vision, we are planning to spread our passion and expertise on family banking and provide financial literacy to millions of families and help them solve real life problems with practical tools. We are also willing to partner up with more organisations and youth charities such as MyBnk, with close ties to communities, locally and eventually internationally, so we can customise our solutions to the geographical needs better and reach even more families through our strategic partnerships.