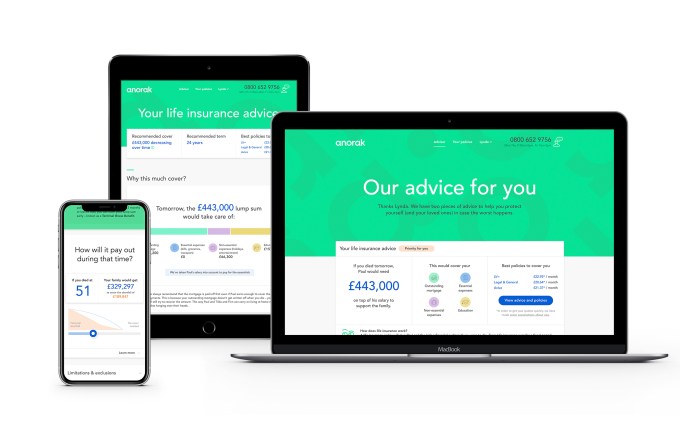

Anorak provides regulated and personalised advice, by utilising machine learning to select and prioritise the insurance policies that fit each users’ needs. Our platform asks for data specifically tailored to each user, to find the best policy options to satisfy each individual’s unique requirements, providing the best value for money.

Our aim is to put people back in control by helping to educate users on the options available to them and make the right decisions.

How did you come up with the idea for the company?

My co-founder (Vincent Durnez) and I realised there was a gap in the market for honest, unbiased advice within the life insurance field, and founded Anorak in 2017 to help to bridge this “advice gap” we were seeing. We wanted to create a platform that put people’s needs at the heart of finding the right insurance policy, as opposed to just being presented with the cheapest option like a price comparison website. From there, the idea grew into a life insurance companion that gives impartial, regulated and personalised advice to anyone who needs it.

More from Interviews

- Meet Stephen Kines, COO And Co-Founder Of Goldilock

- Meet Henry Wilkinson, Co-Founder at Drop-in, Ahead Of The Opening Of Drop-in Richmond

- Meet Oli Cook, CEO and Founder of ekko.

- Meet Marko Maras, CEO and Founder of Trustfull

- Meet Jeff Warren, Chief Technology Officer at Netwrix

- Evgeny Filichkin, Investment Advisor at Keytom & FinTech50 Judge, Tells Us What He’s Looking For From Entrants

- Tracy Prandi-Yuen, VP, Global Partnerships at Boku Inc. & FinTech50 Judge, Tells Us What She’s Looking For From Entrants

- Valentina Drofa, Co-Founder and CEO at Drofa Comms & FinTech50 Judge, Tells Us What She’s Looking For From Entrants

How has the company evolved during the pandemic?

As a business, we were fortunate as our sector is highly defensive, with demand for the product we sell massively increasing over the past year – so much so that our team has had to double in size to keep up with demand. One of the trends we noticed through the pandemic was an acceleration in demand from new distribution partners – including large retail banks – as they work to keep up with and adapt to the growing demand for online services from more young customers seeking protection products. Today, people are far more comfortable with relying on online services to manage their money and larger financial institutions are having to keep up with smaller, more agile challengers.

When it comes to life insurance, many of the traditional products are still extremely complex, designed to be sold through advisers face-to-face – a service most people don’t have access to anyway, let alone during a global pandemic. As a result, providers have had to adapt to survive and sought out services like Anorak to keep them ahead of the curve. While we’re not expecting a full move to automation in the future, over the pandemic many providers started looking for a hybrid approach that allows them to go digital without losing the human element that is still at the heart of the insurance industry.

What can we hope to see from Anorak in the future?

As brokers who provide life insurance, income protection and critical illness insurance, we’ve seen and spoken to many customers who’ve been left weary and financially troubled by the past year. Our aim is to reach as many people as possible, to help make life insurance and financial advice accessible to everyone, so they feel confident that if the worst happened, their families would be looked after.

Our recent £5mill funding round will be used to continue to develop our product (making it the best possible version of what it can be) and in particular, to accelerate our partnerships effort with new distributors – helping us reach more people at this turbulent time. Anorak has the power to open-up alternative distribution channels for life insurance sales which we call “embedded insurance advice”. This is a way for many companies to give clients access to a transparent and easy service that protects their family’s financial future.

Lastly, we are also working on scaling our operations to enable more users to engage with an expert protection adviser if they wish to, by seamlessly integrating this option within our advice model.