-

We’ve collected a panel of experts in lending to give their predictions for the industry in 2021.

-

2020 and the COVID-19 pandemic was a challenging time for lenders and borrowers alike.

-

Predictions have been made by industry experts including Hastee’s James Herbert and Wagestream’s Peter Briffett.

The past year has been a challenging time, both for the lending industry and their borrowers – the COVID-19 pandemic and all the financial strain it has brought resulting in lending suspensions, tightening of borrowing rules and payment holidays.

However, as we enter a new year and a new phase of this health crisis, with COVID-19 vaccines beginning to roll out in the UK, could 2021 be more promising for lending? We’ve asked a panel of industry experts to give their predictions on the matter.

Our Panel of Experts:

- David Beard – Founder of Lending Expert

- Alfie Usher – Founder of Forces Compare

- James Herbert – CEO of Hastee

- Peter Briffett – CEO and co-founder of Wagestream

- Nadeem Siam – Founder & CEO of Fund Ourselves

For any questions, comments or features, please contact us directly.

David Beard, Founder of Lending Expert

“While business levels were quite significantly effected during the first national lockdown in March 2020, it’s now “business as usual” during this third lockdown for the secured loans industry.”

“January 2021 is showing that many second charge lenders still have a good appetite to lend and borrowing rates and products have mostly remained unchanged. The key differences to note are during this third national lockdown is that the housing market has remained open and lenders are able to instruct surveyors for home valuations which is critical to successfully carry out secured lending and mortgage applications.”

“This time round there is no restriction on physical valuations and for over a decade the industry has offered a huge range of products available using Hometrack or similar desktop valuation models.”

Alfie Usher, Founder of Forces Compare

“The last year has been a testing year from lenders across the UK. A combination of covid-19 and compensation claims has made it hard for lenders to operate at any kind of profitable level.”

“However, 2021 is likely to be more optimistic, with many lenders starting to operate again at 25% of their typical lending capacity, or higher.”

“Payday loans are still likely to be popular to the 3 million Britons that use it every year, but there is now a much smaller pool of lenders, so you may find growth in alternatives such as credit cards or secured loans.”

“We expect guarantor lending to make a comeback following the introduction of open banking, which should improve the quality of their underwriting and there should also be a new lease of life once all compensation claims are cleared in March.”

“Either way, payday and personal lending should be more optimistic from the lender’s perspective and it would be good to see some alternatives and new competitors in the mix this year, whether it be payday or salary finance.”

James Herbert, CEO of Hastee

“While the new year may have arrived, for many employees the financial pressures they experienced last year haven’t gone away – on the contrary. This is having a significant effect on people’s lives, their mental wellbeing and, to a degree, their productivity. As a result, many companies are starting to evaluate how they can best support their employees during this difficult time.”

“Recent research has found that over half of workers think having more flexible access to their monthly salary would decrease their reliance on high-cost credit options during the pandemic and give them financial peace of mind. That’s why, in 2021, we anticipate many more businesses will reconsider their payment cycles.”

“They will trial more flexible initiatives like “earnings on demand” and introduce financial management tools such as savings goals, cashbacks and rewards. Many of these come with no additional cost involved for those organisations introducing them but they do increase flexibility and allow employees to make decisions that help positively impact their financial health.”

“When we emerge on the other side of this pandemic, one small positive may well be that companies take the financial health of their employees more seriously. If they do, the benefits this could bring to lots of workers around the UK would be significant.”

For any questions, comments or features, please contact us directly.

Peter Briffett, CEO and Co-Founder of Wagestream

“The beginning of the last decade saw an explosion in payday lending, as operators digitised their services and brought their products online, allowing access to high cost credit at the click of a button. The catalyst for this was the 2008 recession and a weak economy, which historically has always seen increasing demand for pay day loans, as unethical lenders emerge to prey on the lack of liquidity in UK households.”

“The good news in recent years is there has been a declining trend in pay day loan applications, primarily due to tighter regulation and strong moves by the financial ombudsman to put an end to the likes of Wonga and QuikQuid. A stronger economy and low unemployment also dampen demand.”

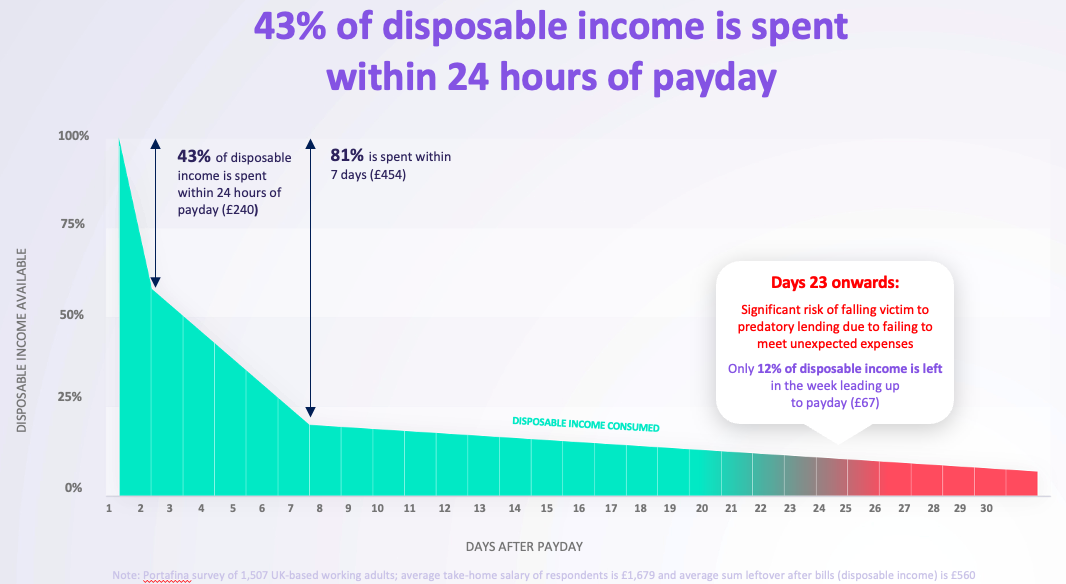

“The underlying gauge for pay day loan usage is always household liquidity, and whilst regulation can reduce the number of operators and bring tighter controls in place, a reduction in liquidity is always a sign the pay day lending sector could rise again. There is no doubt that the pandemic will create a similar environment to 2008, accentuated when furlough and mortgage holidays end in April. The hope is there isn’t a resurgence in traditional doorstep lending, which is almost impossible to measure or regulate.”

“The difference in 2021 is the market is tightly regulated, albeit the need for pay day lenders is ever present, caused by the ‘liquidity trap’ many workers find themselves in at the end of a monthly pay cycle.”

“As has happened so often in the past, unethical lenders emerge in different guises, but with the same base principles. 2020 saw a rise in lenders promoting loans through the employer, paid back via payroll, under the guise of ‘financial wellness’. Companies will have to be cautious of such lenders, like Salary Finance and Salad Money, and also understand the financial stress a worker is put under when they get into a debt cycle caused by short term, high cost credit products.”

Nadeem Siam, Founder & CEO of Fund Ourselves

“For the short term/payday loan sector in 2021 one can only predict that more and more people will need a helping hand to get through some difficult and unsettling times. Where high street banks may not be the solution, the short term offer from payday loan companies may well be the better option.”

“Without a shadow of a doubt, and absolutely understandably, the FCA will no doubt be keeping an even closer eye on how short term/payday loan providers treat their customers. Making sure their customers are treated fairly and justly ensuring borrowers only borrow what they can afford.”

“Provided that the pandemic has been contained/controlled after this first quarter, 2021 and for the foreseeable future, will be a period of rebuilding, reflection and hope. For the short term/payday loan sector this could mean an increase in borrowing as confidence in the economy grows again. Similarly, in our peer-to-peer sector, investment should increase again with such confidence. Pandemic pending of course.”

“At Fund Ourselves our brand positioning ‘Giving control back to the customer’ is important to us and is aligned with the harsh environment we currently face, totally focused on helping our customers/borrowers by providing a means to an end.”