Innovation is defined as ‘something which adds value where it hasn’t been before’. Auderli founder Steve Crouch wanted to fill an obvious gap he saw in the industry to create a platform which benefits professional advisors and individuals alike. The result is a truly innovative start-up product which may influence financial and life organisation as we know it.

What is Auderli? What do they solve?

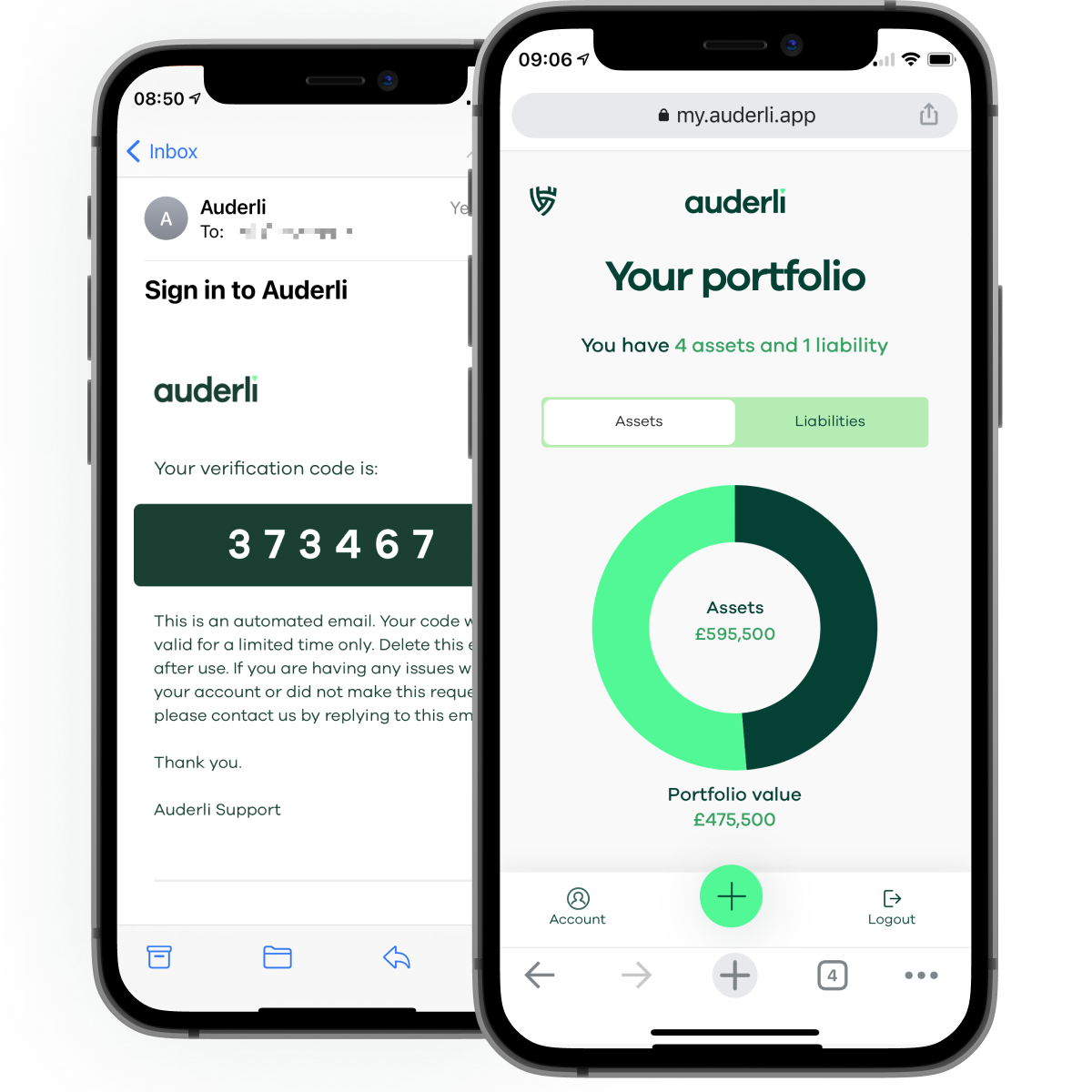

Auderli is a web-based life management app which allows users to upload and store their financial information and life documents in one secure place, and then gives them the option to share their portfolio with loved ones, advisors or business partners.

Born from one tax specialist’s frustration at never having all of his client’s information in one readily accessible place, Auderli aims to solve the often lengthy process of working out exactly what you’re worth and trying to locate necessary documents when seeking financial advice or tackling financial admin.

Once information is added into their software, Auderli gives users an instant interactive display of their net worth and compartmentalizes it into different sections. Auderli takes into account a person’s assets and liabilities to determine the overall value of their estate. By letting you track everything from mortgages and loans to pensions and valuable items, peace of mind and improved financial wellbeing are at the top of Auderli’s priorities.

Important life documents can be uploaded via an image or digital file and then stored securely in the cloud system, allowing for quick and easy access whenever needed. These include property-related documents, wills, pensions, insurance, bank statements and anything else that’s important to the user. They can then instantly share their portfolios with whoever they authorise, which is beneficial when working with a financial advisor or business partner and when sharing finances with a partner in general or family if extra support is ever needed in the future.

Auderli is building a reminders feature so that users never forget when important financial dates are approaching, such as the renewal of an insurance policy.

Who is Auderli for?

Tailored for both individual and business use, Auderli is for people/companies of all ages and economic statuses.

Some examples of individual users would include people buying a home, people just starting out in their career, people with families, people with fast-growing net worths and people approaching retirement age. There are countless life stages which require good financial organisation, and therefore countless people who would benefit from the services that Auderli offer.

In terms of business use, whether you’re someone who works with other people’s finances or a business that needs to share information with business partners or employees, Auderli’s features streamline these processes so that professionals can better advise clients or spend more time growing their business.

The Journey so far

Auderli was created during the pandemic by founder and tax specialist Steve Crouch, after he noticed a gap in the market for a platform which could improve the process of working with client’s finances. Frustrated at the lack of information and documents, Steve thought of the idea for Auderli and then got to work presenting his idea to a bank who then helped provide the first round of funding.

A team of experienced people was set up remotely and they have worked ever since to build a fintech platform which they feel can make a huge difference to the financial wellbeing of their users.

More from News

- What Influences Bitcoin Prices And Fluctuations?

- World’s First AI Chef To Come This September. Here’s How It Works

- Microsoft Who? Nvidia Has Officially Become the First Company to Surpass a $4 Trillion Market Cap

- Are AI Startups Investing In Teachers Learning AI A Good Move For Education?

- Can a Robot Really Perform Surgery Without Human Help?

- Reports Show Fewer Students Chasing Tech Careers, Here’s Why

- Undersea Cables And Digital Systems At Risk, MPs Warn

- Government Partners With Google Cloud To Modernise Tech, Here’s How

What makes Auderli innovative?

- Security features

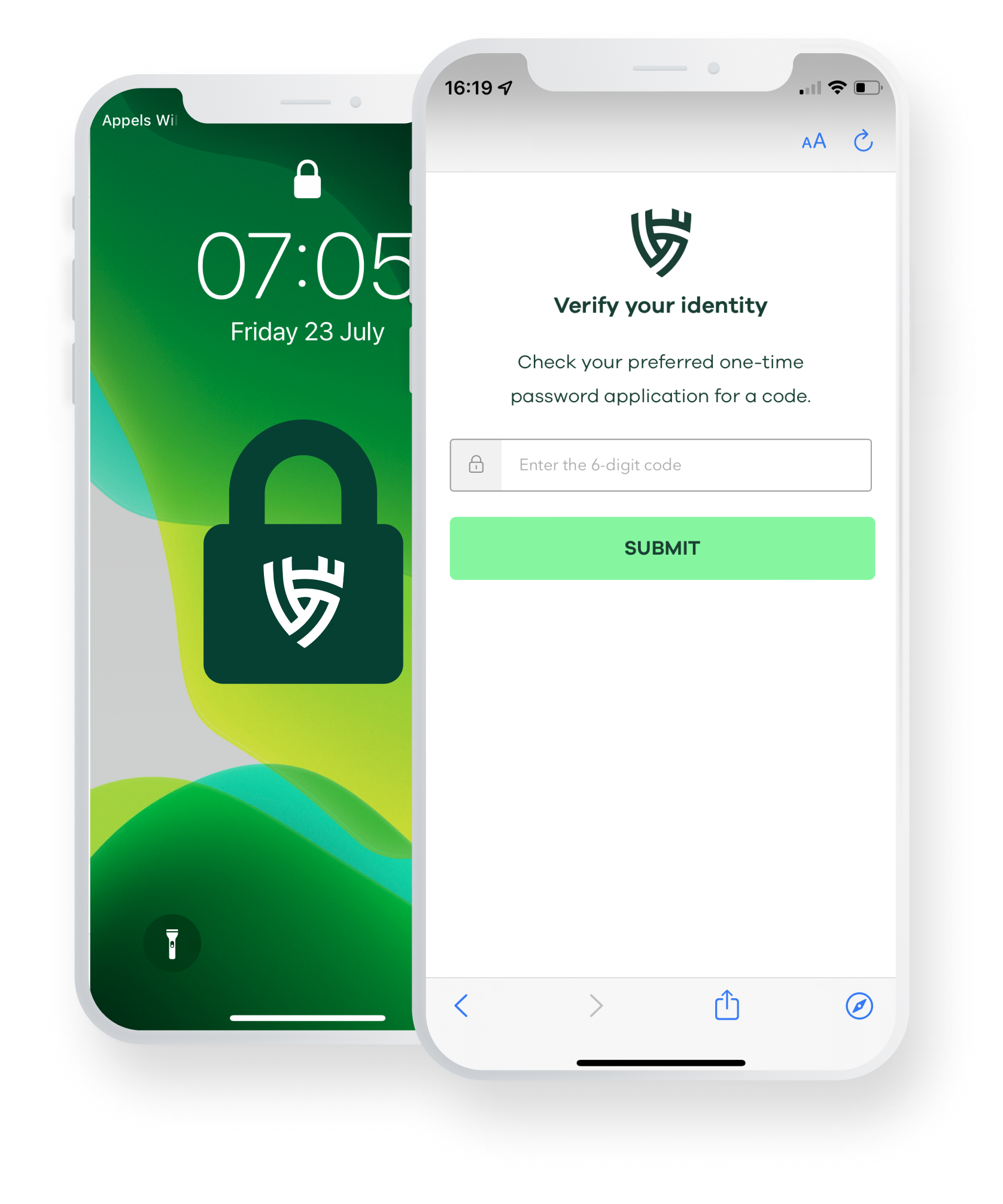

- Auderli uses advanced security measures such as multi-factor authentication and passwordless login to ensure their users maximum protection for their important documents.

- Portfolio sharing

- Allowing others to view financial information is a transformative idea which attempts to destigmatise the secrecy attached to finances. Through Auderli’s secure platform, this allows improved communication between families and professionals which ultimately benefits everyone involved.

- Net-worth calculator

- Auderli’s net-worth calculator is an innovation in that it lets you store and update all the relevant information when necessary and also includes valuable personal items in your assets, which is often not the case.

- Document storage

- What sets Auderli’s document storage system apart from typical cloud storage platforms is that you can store and manage the documents behind each important asset or liability, making them easier to access as there aren’t all types of documents in one big storage area.

Where is Auderli heading next?

Looking to the future, Auderli have many exciting new features and sections lined up, including:

- Open banking

- Connecting with bank providers to provide real time figures which update automatically

- Family Section

- For wills, life insurance and health insurance etc.

Auderli’s next focus is also on seamless integrations with pension providers, banks, utilities and various fintech businesses which is the job of Rob Searle, Head of Sales and Partnerships. Having already partnered with the likes of PensionBee and Tide Bank, we will be allowing users to view real-time balances across their portfolio. They are looking to work with even more enterprising brands. Partnering with companies in this way will allow the app to have more intuitive features that benefit users but also allows partner companies to use Auderli to improve their relationship with their clients.