-

Cuvva gets backing from European investors for next stage of its mission to rebuild insurance

-

The disruptor will launch a revolutionary pay-monthly product early in 2020

-

RTP Global, Breega and Digital Horizon join existing investors LocalGlobe, Techstars Ventures, Tekton and Seedcamp

-

Angel investors include Dominic Burke, CEO of multinational insurance broker Jardine Lloyd Thompson; Faisal Galaria, former chief strategy and investments officer of GoCompare and Cuvva’s new chair Bruce Carnegie-Brown, chairman of Lloyd’s of London, former chairman of MoneySuperMarket

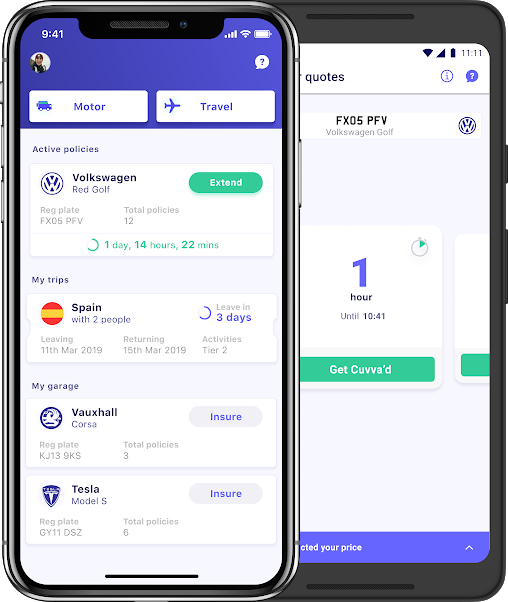

Cuvva, the insurance disruptor, that began as an app offering pay-as-you-drive motor insurance, is about to take on the UK’s biggest insurers having raised £15 million ($19 million) of venture capital backing to target the long-term motor insurance business.

RTP Global, Breega and Digital Horizon have joined seed investors LocalGlobe, Techstars Ventures, Tekton and Seedcamp to invest in the app-based insurance platform, which recently announced the appointment of the Lloyd’s of London chairman as its chair. Angel investors from the insurance sector, including Dominic Burke, the CEO of Jardine Lloyd Thompson and Faisal Galaria, the former chief strategy and investments officer of GoCompare, have also put in capital.

Cuvva’s Series A funding comes as the company prepares to launch a pay-monthly insurance product for the first time, a key step in its ambition to provide one gateway app to serve all consumer insurance needs.

Freddy Macnamara, founder said: “The way insurance is sold hasn’t kept up with the way people live their lives now. We buy lots of goods and services via flexible subscriptions to suit our on-demand lifestyles. Why shouldn’t you be able to do that for insurance?

“I started Cuvva when I couldn’t find flexible insurance to help me share my car. Four years on from launch we are still discovering how big the problem we are solving really is. We’re now selling 3% of all UK motor insurance policies but we’ve got so much further to go. Cuvva is going to be the place where you buy all your insurance, all through our mobile app.”

The pay-monthly motor product will launch early in 2020 and could cut average annual bills for car owners significantly. Cuvva plans to cut out all middlemen including brokers and comparison websites, which charge insurers about £70 on each policy sold. Unlike legacy insurers, Cuvva will not charge a fee to spread payments over the year and it will not penalise loyal customers with dual pricing. The startup will offer the same savings, whether you are signing up as a new customer or a returning customer. It also won’t charge admin fees to alter personal details, like a change in job title.

“The way motor insurance is sold is particularly unfair and inflexible but we can make it cheaper by cutting out the middlemen and removing the penalties for paying monthly, which hurt younger drivers or lower-mileage drivers disproportionately.”

“The insurance industry across Europe is ready for a fresh approach. The UK has a long history of initiating change in the way that insurance is sold and Cuvva has devised a product that has incredible appeal for a new generation of car owners and borrowers. We are thrilled to be able to begin this journey to build a whole new way of buying insurance with Freddy and the team,” Anton Inshutin, managing partner at RTP Global, said.

“Cuvva has an exciting vision for what a customer-centric insurer will look like and is unafraid to take on the middlemen in this sector and dismantle a raft of ‘traditional’ fees and penalties. Their fundraising also comes at a time when there is real appetite for innovation in insurance,” Ben Marrel, partner at Breega, said.

“I see a fundamental shift in demand for insurance from offline products adapted for websites, to the truly digital, mobile-first offering. We believe the aggregator dominated market model will be challenged strongly by digital insurance products and the adoption will be very fast. The founders of Cuvva have a solid track record of building great digital products and I believe they are in the right place at the right time with the right team,” Alan Vaksman, founder and managing partner of Digital Horizon, said.

Since pioneering hourly insurance in 2016, Cuvva has sold more than 40 million hours of insurance and has over 250,000 customers, becoming the UK’s most downloaded insurance app. It has also expanded beyond insurance aimed at drivers who want to borrow a friend’s car into flexible single trip travel cover.

The London-based company will use the proceeds of its fundraising to build the team, adding engineers, developers, marketeers and customer operations staff to its 80-strong team. Over the next 18 months, it expects to double in size and already has a 30 strong in-house customer operations team.

Cuvva’s app also includes features such as MOT reminders, tax reminders and advice on where to buy the cheapest petrol. The platform promises exceptional customer service with in-app live support that offers one minute response time, 24 hours a day.