- Manchester experienced the greatest take-up of office space at 1,750,562 square feet in 2018 – a 44% increase from the previous year

- Manchester also benefited from the highest office investment volume at £989 million – an 8% rise from the year before

- Thereafter, Glasgow saw a take-up of 962,921 square feet in office space and gained an investment level of £468 million

- Notably, Leeds experienced an astonishing 185% year-on-year increase in office investment – from £127 million in 2017 to £362 million in 2018

- ‘Location’ (84%) is the primary consideration in the search criteria for most businesses seeking a new office premises in 2019

Despite the economic and political turbulence caused by Brexit – aspects such as the UK’s talented labour pool, strong financial markets, transparent laws/regulations and advanced technology infrastructure – still makes the UK an attractive proposition for businesses/investors seeking to set-up or expand their operations.

Interested in office investment, commercial property specialists SavoyStewart.co.uk analysed the latest findings from several regional city reports complied by Knight Frank, to discover the total ‘investment volume’ and ‘take-up’ of office space in 10 major cities across the UK in 2018.

The 10 cities included within the research are as follows: Aberdeen, Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds, Manchester, Newcastle and Sheffield.

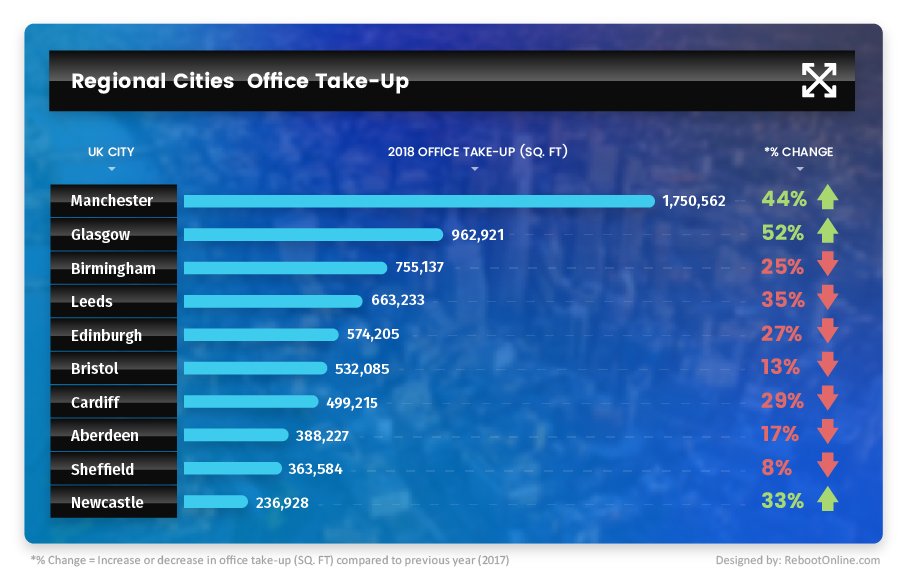

Office Take-Up (SQ. FT)

Savoy Stewart found that Manchester experienced the greatest take-up of office space at 1,750,562 square feet (sq. ft) in 2018. In comparison to the previous year (2017) – where office take-up was 1,218,892 sq. ft – marking a significant 44% increase.

Thereafter, Glasgow saw a take-up of 962,921 sq. ft. in office space – equating to a 52% rise from 2017, when office take-up was 633,710 sq. ft. Birmingham followed, with an office space take-up of 755,137 sq. ft.

Out of all the considered cities, Newcastle had the lowest take-up of offices at 236,928 sq. ft. Despite this, the city still had a 33% surge from the year before (2017) – where office take-up was 177,870 sq. ft. Slight above, was Sheffield, who had an office take-up of 363,584 sq. ft in 2018.

Overall, 6,726,097 sq. ft is the grand figure, when totalling each of the ten cities 2018 office space take-up together.

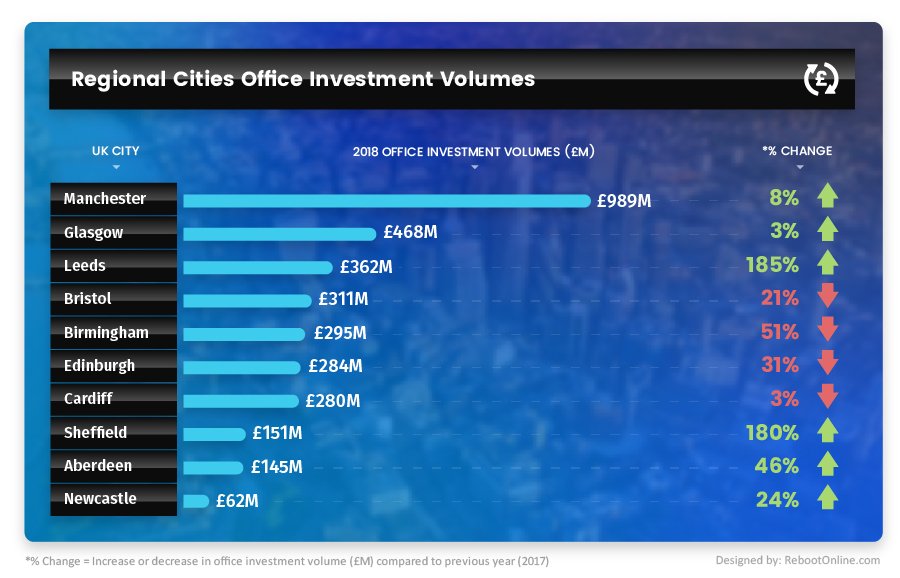

Investment Volumes (£M)

Manchester benefited from the highest office investment volume at £989 million in 2018. This represented an 8% increase from 2017, where the investment figure was £917 million.

Subsequently, Glasgow gained an investment volume of £468 million. This was a 3% rise from 2017, where office investment level was £453 million.

In third position was Leeds, with an office investment of £362 million – illustrating a hefty 185% increase from the year before (2017 = £127 million).

Contrastingly, Newcastle has the lowest office investment volume from the ten cities at £62 million. This though, was still a 24% rise from 2017 – where office investment amounted to £50 million.

Notably, Sheffield was one of the other cities which had a substantial year-on-year increase (180%) in office investment – from £54 million in 2017 to £151 million in 2018.

Collectively, £3.347 billion is the staggering sum, when totalling each of the ten cities 2018 office investment volumes together.

Ranked: Most important factors for businesses when considering prospective office spaces

Moreover, Savoy Stewart surveyed 436 office-based businesses from a range of industries, who are all looking for new working premises this year – to discover the factors (other than price) they are mainly focusing on in their search criteria. They ranked as follows:

1) Location (e.g. Ease of access for employees/clients etc.) – 84%

2) Current size (e.g. Enough space to accommodate all employees, furniture, technology etc.) – 76%

3) Legal considerations/Added Costs (e.g. Lease flexibility, utility bills, contract complexity etc.) – 73%

4) Infrastructure (e.g. reliable internet connection and telephone lines etc.) – 69%

5) Availability of parking space (e.g. for employees, clients etc.) and local amenities (e.g. coffee shops, restaurants etc.) – 67%

6) Future growth (e.g. Simplicity of carrying out potential expansion and refurbishments etc.) – 58%

7) Style/layout (e.g. does interior and exterior fit with desired brand image etc.) – 52%

8) Presence of competitors in the area – 25%

Darren Best, Managing Director of SavoyStewart.co.uk commented:

“With the uncertainty of Brexit glooming over the UK, it is not entirely discouraging businesses from searching for and acquiring new office space. On the face of it, take-up and investment volumes in different cities outside of London indicates a strong and promising outlook for the office market. Though some cities scope for office space seems to be more active and resilient to economic pressures than others. Looking ahead, this research also provides a great insight into the primary factor’s businesses are putting high on their agenda when searching for office premises this year. With some surprising outcomes”.