- Frank Zhou started Zeux with a seed funding of $700,000

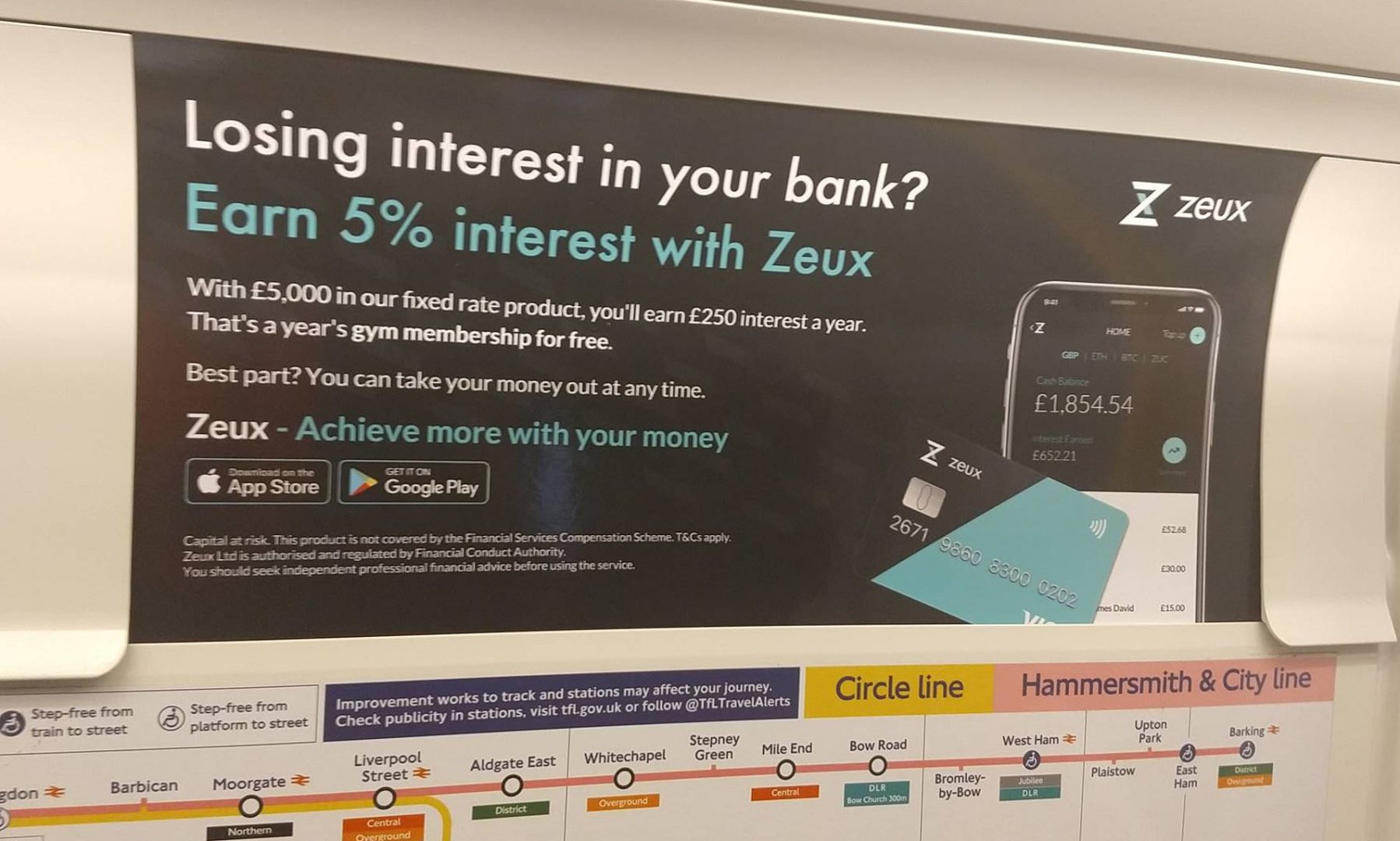

- The app offers customers a high interest saving alternative option, no FX fees when spending abroad and other money management tools

- Zeux connects UK users with investment products overseas, offering higher returns available in Asia and other geographies

We meet with entrepreneur Frank Zhou in a trendy café in Holborn. The Chinese-born entrepreneur has been making a lot of noise in the fintech industry with the launch of his all in one money management app, Zeux.

“The UK fintech boom started around 2014,” explains the well-presented Oxford graduate and former City trader of 10 years. “Fintech is very established in parts of Asia, but it is still emerging in Europe and there is no real market leader. It was a good time to get involved with Fintech in the UK, not too early, nor too late.”

“In China, the innovation is quite far head.”

Zhou’s phone is buzzing constantly but he ignores it as he continues to tell us more.

“Even homeless people in China are accepting donations through QR codes and contactless.”

When you invest in some of the Zeux app products, your money is converted into cryptocurrency and invested in other platforms in Asia, including their Chinese partner WeCash in Beijing, in order to provide competitive results which high-street banks don’t offer.

The app also offers a money management platform where you can see all your accounts in one place, categorise spending, get instant notifications, no added fees when spending abroad and no fees for receiving international transfers.

When questioned over whether Zeux was trying to do too much, Zhou calmly responds “Customers do not want to have 20 apps on their phone or switch banks every time they want to make an international transfer. Our goal is to connect all these services. With Zeux, UK customers can access all these products and tools in one app.”

“The initial response was overwhelming.”

The company initially received an institution investment of $700,000 and gauged attention by sending it to his own network of connections. Since then, Zeux has seen an accelerated rate of customer growth and recently closed another round of $1.25m more.

“The initial response was overwhelming. We thought may we would get a few sign ups and people investing here and there, but the sums exceeded our expectations. The average top up for our active customers is very high and probably highest uptake has been from ex-pats living in the UK, who are more familiar with these types of all-in-one money apps.”

Zeux was brought into the mainstream following a huge advertising campaign on Transport for London which raised a few eyebrows earlier this year.

“Getting some feedback or criticism is normal and it often happens to new innovative solutions – we feel the exposure is good when we are trying to get the name out and get new customers on board. We’ve taken constructive comments on board and we’re constantly working on improvements. ”

“ The interest rates in the UK are very low, comparable to internationally and Zeux is now offering a tool that connects UK customers to a range of international financial products. We follow the yield. Where there are best returns, we will find them and offer them to our customers.”

The 20-strong team with offices in Green Park is currently in the middle of another funding round and it won’t be long before Zeux becomes a household name.