- Cleo is an AI technology startup offering an intelligent assistant to help manage finances.

- The fintech startup was founded in January 2016 by Barnaby Hussey-Yeo.

- Cleo has raised a total of $13.3 million in funding.

About Cleo

Barnaby Hussey-Yeo, Founder & CEO of Cleo AI, studied machine learning at Bristol University. He previously worked as a data scientist at Wonga, and it was there that he learned about financial services and banking. After noticing how many people were stuck in their overdraft and reliant on credit cards, Barnaby wanted to create something to help them make better decisions in the long term, and guide them through their finances. He set out to build Cleo AI as a digital finance assistant with the Entrepreneur First incubator – Europe’s leading pre-seed investment programme for technical founders. The London-based artificial intelligence startup is now responsible for incubating 50 of the fastest-growing startups in Europe.

How Does It Work?

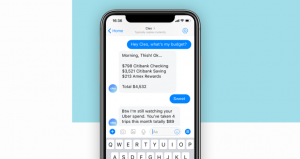

Cleo is a free service and aims to help people better manage their finances. When you connect Cleo to your bank account, the AI digital assistant analyses your spending patterns. The transaction data from your bank is classed into recognisable merchant names and then classified into categories such as transport, shopping, entertainment, and more. It then uses its intelligence to tell you about your finances. The chatbot gives you insights into your spending across multiple accounts and credit cards, broken down by transaction, category or merchant and notifies you when your balance is low.

Additionally, Cleo helps you put money aside or save for a specific goal, send money to your Facebook Messenger contacts, give donations to charity and set spending alerts. You can also ask her questions, and she’ll provide you with advice, such as how much should I spend on dinner? Am I overspending on my credit card? Or even, is this the correct mortgage for me? Machine learning technology is fundamental to Cleo. The AI app uses natural language processing, which takes in the unstructured text of somebody’s request and creates the correct intelligent response.

The fintech also offers Cleo Plus, a subscription product which provides even more support to your finances. The premium service presents a range of features, including rewards and an optional £100 cash advance as an alternative to going into your overdraft. The Cleo platform uses bank-level encryption and will never save or sell any of your information. Nevertheless, your bank account is still backed by a $250k guarantee to cover you should the unthinkable happen.

Cleo’s Success

In March, Cleo reached 3 million users. The company stated: “Recently, we reached 3 million stackers, hustlers – BOSSES – in our community.”

Cleo has raised a total of $13.3 million in funding over four rounds. Their latest funding was raised in June 2019 from a Debt Financing round by TriplePoint Capital. Alongside TriplePoint, some of the biggest VC firms in London’s tech scene back Cleo, including Entrepreneur First, Balderton Capital, LocalGlobe, Octopus Investments, Y Combinator, Index Ventures. Additionally, Moonfruit co-founders Wendy Tan White and Joe White, Skype founder Niklas Zennström, Wonga founder Errol Damelin and TransferWise founder Taavet Hinrikus have invested in Cleo.