- Cuvva is a London-based insurance provider, launched in 2016 by Freddy Macnamara.

- Cuvva is currently the most downloaded insurance app in the UK.

- In 2019, the startup raised £15 Million in Series A Funding to support growth.

About Cuvva

Cuvva aims to provide simple and flexible insurance products to contrast the often complication and convoluted process of insurance purchasing. CEO Freddy Macnamara founded Cuvva when he struggled to find flexible insurance that allowed him to share his car. The startup hopes to revolutionise the way insurance is bought and sold in the UK by providing products that better suit on-demand lifestyles.

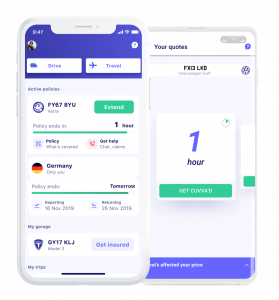

Cuvva provides personal car insurance available by the hour through the mobile application, as well as leaners’ and van insurance. Since 2019, Cuvva has also sold flexible single-trip travel insurance. Cuvva’s products provide an option for those who can’t afford the upfront cost of annual cover or require the flexibility not to be held to a yearly contract. It is also available at the last minute, for circumstances in which you might forget to purchase travel insurance or need to drive someone else’s car.

How Does it Work?

Cuvva is modernising insurance products and process to rival outdated businesses. They were the first insurance company to introduce hourly car insurance policies in the UK and the first to sell policies through an app.

The user-friendly mobile app allows users to purchase insurance in a couple of minutes and provides constant support throughout the process. The in-app support team is available 24/7 with an average one minute response time. The application also includes managing features such as MOT and tax reminders and advice on finding the cheapest petrol in your area. Cuvva hopes to become an all-in-one platform for managing insurance needs and beyond.

£15 Million in Series A Funding

In December 2019, Cuvva raised £15 million ($19 million) in a Series A funding round. The venture capital backing saw the involvement of RTP Global, Breega and Digital Horizon, joining existing investors LocalGlobe, Techstars Ventures, Tekton and Seedcamp. Angel investors from the insurance sector, Dominic Burke and Faisal Galaria, also contributed capital. This funding has supported Cuvva’s plans for growth, including pay-monthly car insurance set to launch in the coming months. The pay-monthly products will continue to promote flexibility and simplicity and aim to solve a gap in the market for customers who cannot afford yearly insurance upfront but wish to avoid paying additional fees or interest.

According to MIB, Cuvva was responsible for 4.5% of all motor insurance policy sales in the UK by volume at the end of 2019. Currently, Cuvva is the most downloaded insurance app in the UK.

For more information, see https://www.cuvva.com/