How does an insurance software work?

If you are looking to power an insurance company, provider or broker, you will need a full suite of software to manage all the processes including:

- Customer journey

- Underwriting

- Leads management

- Partnerships with other insurers and brokers

- Documentations

- Finances

- Claims

- Reporting

For some insurance companies, they build and keep their software in-house. However, in many cases, insurance brokers and vendors using different software and solutions which are white-labelled and easily integrated into their company’s processes.

This can often be more affordable and offer a fully scaled solution, rather than the potential delays of starting up and the costs of having developers in-house. With this in mind, we spoke to insurance software company, Optalitix, to better understand their proposition which has been adopted by the likes of Vitality and GoCompare.

About Optalitix

Optalitix was founded by a team of data scientists and actuaries in 2012, with one of the founders, Dani Katz, previously working in corporate actuary at Vitality Health.

The Camden-based team has over 20 staff and has build a number insurance models and processes for insurance providers and brokers across vehicle, health and life insurance.

To make an enquiry, email [email protected]

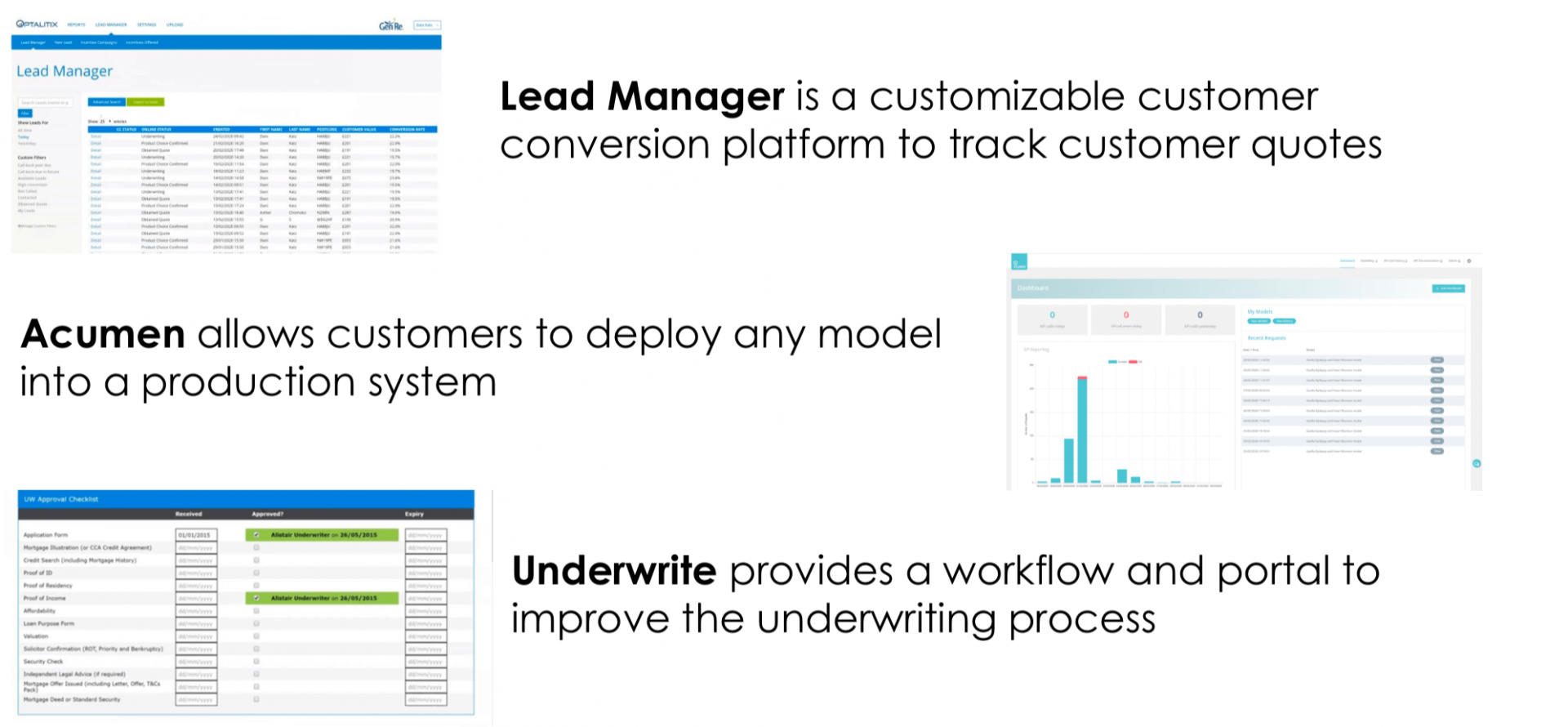

The Three Insurance Software Products Offered by Optalitix

- Leads Manager – Manage any leads coming into your business and monitor their progress to maximise conversions.

- Acumen – Create underwriting decisions and integrate these easily without needing a developer

- Underwrite – Track your underwriting progress, create diary entries and store policy documents

The insurance software available from Optalitix

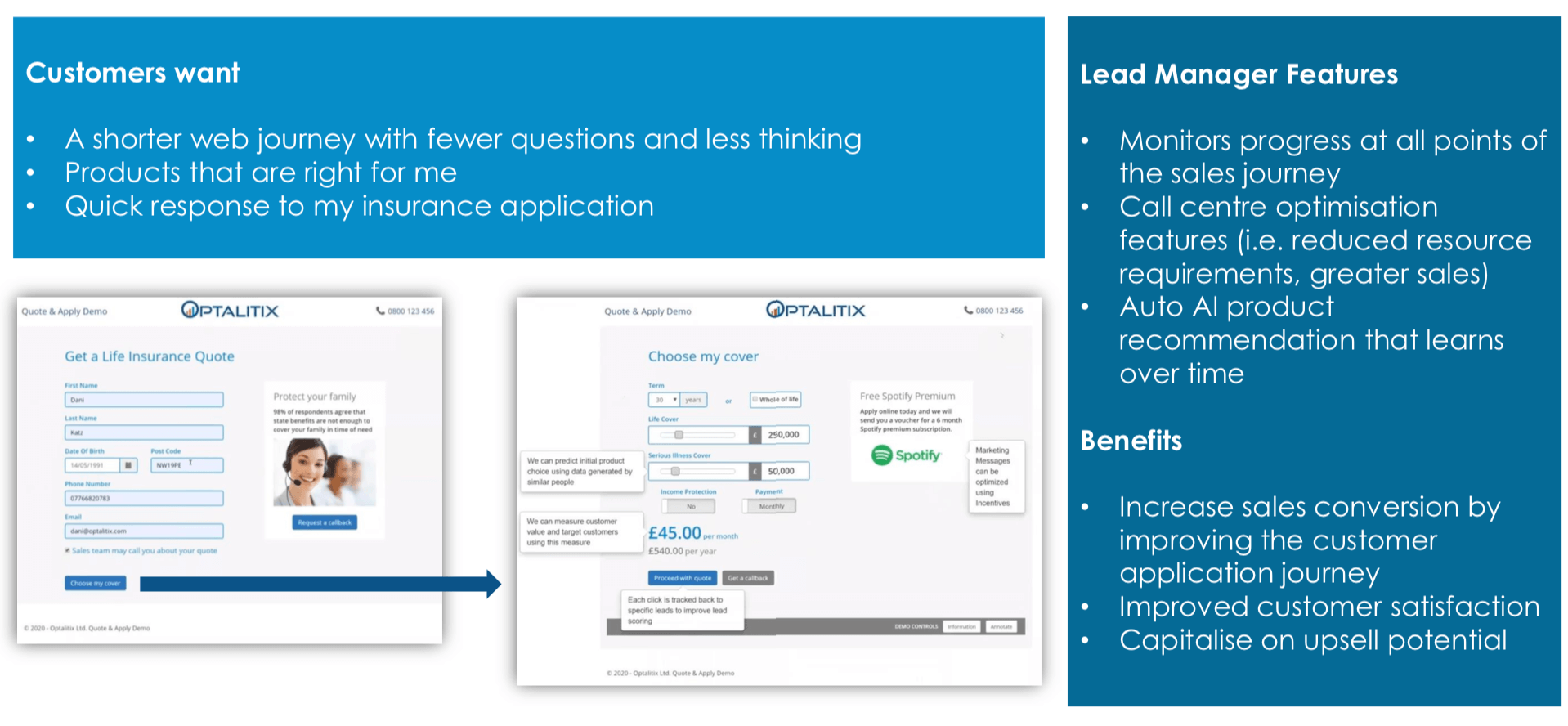

Customer web journey – Personalise the customer journey with your key questions, product types and requirements. Monitor progress at all points of the sales journey and connect it to your call centre to boost sales. Maximise your sales conversion by improving the customer application journey and capitalise on any up-sell potential.

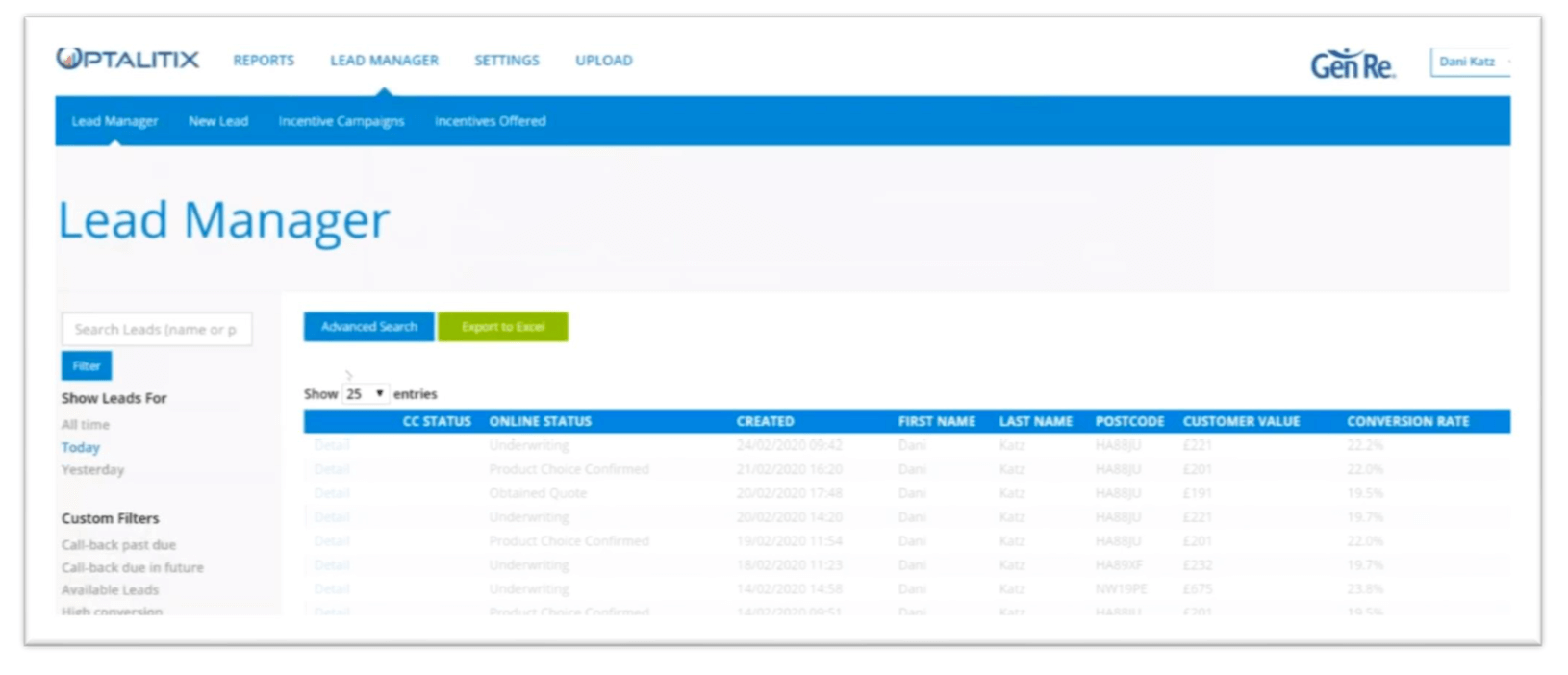

Leads manager – Use the leads management dashboard to find and search for any live and historical leads and enquiries. Use the tool to drive conversion and follow up with new and existing customers.

Customer insights – Access data on each customer and application and use this information to provide better quality and recommend other products and renewals.

Underwriting – Track the underwriting workflow and make rapid decisions to your decision engine and scoring without developer input. Track any live applications and store any insurance documents.

Manage brokers and insurers – Manage multiple partners on the site and access live reports of any leads and enquiries that they generate and convert into customers.

Finances – Monitor any insurance policies, pricing, claims, pay-outs renewals and more. Process any income and payments out using their insurance software.

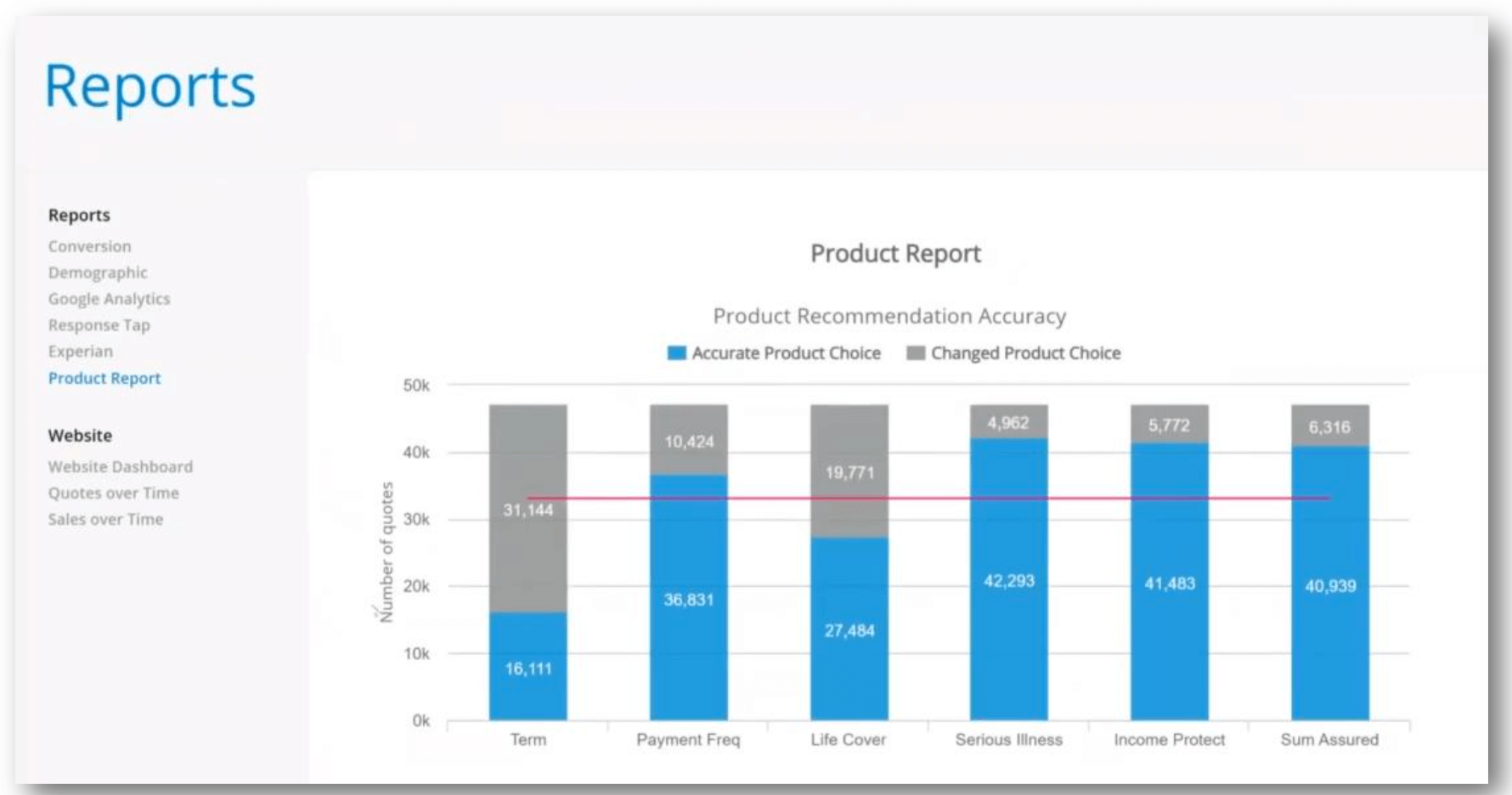

Reporting – Access live reporting on the full insurance customer process including any enquiries, live applications, conversions, data insights and more.

Who Can Use Optalitix’s Insurance Software?

Customers include those looking for:

- insurance broking software

- insurance quote software

- insurance underwriting software

- health insurance software

- life insurance software

- car insurance software

Do I Need Insurance Software for My Business?

There is a business case for using an insurance software over building a platform on your own. For some startups or new insurance businesses, the ability to use a software allows you to integrate your brand and its underwriting scorecard with a software quickly and you can start operating relatively soon. So where timescales are crucial, a software could get you up and running fast.

Whilst the cost of your insurance software will depend on your specification, you have peace of mind knowing what the fixed cost is, meanwhile building something bespoke could overrun and lead to additional costs. You also have the risk that in-house developers can be costly and with salaries at £50,000+ per year and day rates of £500 per day, this can quickly add up.

Optalitix, like other similar insurance softwares, they give you the opportunity to make rapid changes to your underwriting or customer journey – and this is on par with having a developer in-house.

How Much Does Insurance Software Cost?

The cost of insurance software will depend on your specification and requirements. There is often an initial set-up and integration fee to get you started and then an ongoing monthly fee which will depend on things like volumes of enquiries or any add-ons.

To get a quote, email [email protected]