- New financing to help Grover level access to tech, capitalising on rising consumer demand for ‘access’ over ‘ownership’

- Funds will be used to support international expansion of Grover’s circular electronics subscription service, avoiding 24,000 tonnes of e-waste by 2024

- Includes an extension of Series B, bringing the total size of the round to $100m.

Grover, Europe’s market leader in consumer tech subscriptions, today announces it has secured over $1billion in equity and asset backed financing to democratise access to tech while tackling the world’s prolific e-waste problem.

In what is the largest ever financing round for a start-up in the circular economy space, Grover will use the fresh capital to accelerate growth and global expansion in new and existing markets. The finance will allow Grover to increase circulations from 475,000 to date to 5 million by 2024.

More from Tech

- What Are the Problems with Air Source Heat Pumps?

- How Solar Powered Batteries Are Shaping The Future Of Green Energy

- 71% Of People Struggle To Stay Focused Due To Digital Overload

- How To Choose Between A Web App and A Native App

- We’ve Heard Of Smart Homes, But What Is A Smart City?

- Experts Share: What Will Medtech Startups Build Around AI Diagnostic Systems?

- UK vs US: Whose Tech Industry Is Performing Better In 2025?

- Experts Share: How Can Diagnostic AI Be Integrated Into Existing Medtech Systems?

The round is made up of a $1bn asset-backed facility from London based Fasanara Capital, and an extension of its Series B funding round from $71m to $100m. The debt funding will be provided to a special purpose entity which will acquire and own the products Grover’s customers subscribe to. This structure separates ownership of the assets from Grover’s subscription platform, allowing the company to focus on product development, customer acquisition and international expansion.

Responding to surging customer demand, the company nearly doubled its subscription base during the first half of the year and is already offering access to close to 250,000 tech products.

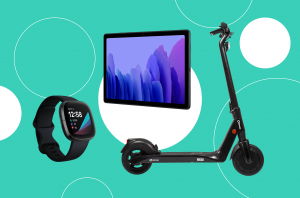

Grover enables people and businesses to rent technology on a monthly basis, removing the need for upfront capital expense and allowing for more flexibility than an outright purchase or financing plan. The subscription service levels access to tech by allowing subscribers to select from over 3,000 products, allowing them complete control of the subscription length to maximise affordability. At the end of the original subscription period, the customer can either buy the product, send it back or continue on a month-to-month basis.

Returned products are refurbished to an ‘as new’ condition and recirculated to make sure they stay in use and out of landfill. When the product reaches the end of its life, Grover’s circular supply chain ensures the materials are reused or recycled. Consumers also enjoy stress-free subscriptions, with 90 per cent of the cost of any damage covered as standard.

Grover’s founder and CEO, Michael Cassau said: “Consumer electronics are fundamental to modern life and we believe that everyone should have access to the tech they need at prices they can afford. However, the linear nature of society’s consumption over the years has led to e-waste becoming the fastest growing waste stream in the world.

We’re capitalizing on a major shift in consumer preferences to bring more tech to more people, while reversing the alarming e-waste trend that has such severe environmental consequences. So far, we’ve circulated 475,000 products, equivalent to 1,400 tonnes of e-waste. This latest round of financing is a huge vote of confidence from our investors and will allow us to realise our goal of becoming the world’s leading sustainable electronics subscription brand.”

Grover is already active in Germany, Austria, the Netherlands and Spain, and plans to launch further markets in Q4 2021.

Francesco Filia, CEO of Fasanara Capital said: “Grover has gone from strength to strength and is well on its way to dominating the $280bn addressable tech subscription market. Consumer preferences are quickly steering towards a subscription economy for electronic products, and as Europe’s fastest growing company in that space, Grover is poised for significant growth as a result. The growth Grover has seen over the past 12 months is testament to the world-class founder-led management team, and we look forward to supporting them at this very exciting point in the journey.”

According to the UN, the world generates over 50 million tonnes of e-waste each year, only 20 percent of which is recycled. By the end of 2024, Grover aims to have 5 million product circulations which will avoid 24,000 tonnes of e-waste.

Grover’s investors to date include JMS Capital-Everglen, Viola Fintech, Augmentum, Coparion, Circularity Capital and Samsung Next.