There are several traditional ways to save money on car insurance including comparing prices between insurers, using a no claims bonus and paying a high voluntary excess. However, with the advances in technology and insurance policies available, we are pleased to provide some of the smartest ways to save money on your car insurance premiums in 2018.

Firstly, we need to consider what determines the cost of a policy and this is mostly based on the risk of the driver making a claim to their insurer and the company having to pay out a claim. Any reduced risk in making a claim will therefore lead to a lower cost in insurance. Some demographics are already eligible for lower rates based on their age (40 to 60 year olds are considered most experienced) and area they live in – as areas with low crime, little traffic and good quality roads are deemed low risk. Other factors include mileage whereas the more miles you do, the greater risk you have of being involved in an accident. The most modern ways to save are explained below:

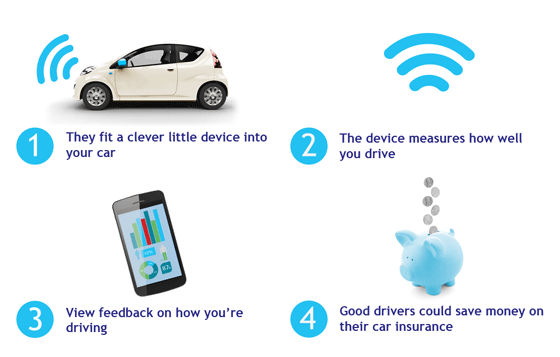

Telematics Insurance

This involves adding a little black box under your dashboard, which is about the size of a smart phone. Using telematics or GPS technology, it monitors your mileage and quality of your driving. The data is connected to your insurer who can see how well you accelerate, brake, turn and speed and if they can see that you did less mileage than predicted and can see that you are a safer driver, they will gladly lower your premium. Telematics insurance has said to help the average person save around 20% on their policy and it is particularly helpful for young drivers who are branded a higher risk from day one, but here they get to prove that they can drive well and save money.

If you’re interested in data on road safety across the UK, check out the guide here.

The information can be accessed from the driver’s smart phone app or online and they can actually review the quality of their driving. So it is very measurable and transparent and offers a great way to save. It is also important to check the data because there have been known to be some anomalies, so it is always good to double check. In the future, there is talk that telematics will help insurers assess claims more accurately. (Source: The Express)

Up-to-date Safety Features

Traditional safety features include the standard locks and alarms that come with a car and also putting it in a garage overnight and making this information available to your insurer. More recent safety features include adding a tracker to your vehicle so that it can be found in the event of theft. Some trackers are connected to the police so that the authorities can find the vehicle themselves and provided that it can be returned in one piece (minus a few dents), the amount you claim will be very limited.

Another clever safety feature is the immobiliser which locks the engine of the car if it is not turned on with the correct ignition. This stops any potential thieves or fraudsters hot-wiring your car or making a duplicate key. A Thatcham approved Immobiliser can cost less than £100 but can help you save significantly more on your insurance for several years to come.

Buying Cover In Bulk

Insurance providers are getting more sophisticated at offering insurance for bulk in the form of multi car or fleet insurance. Whilst multi car used to just be for your immediate family or spouse, several insurers now extend this to anyone else you want to share your policy with including neighbours, friends and other family. The idea is that buying insurance in quantity offers a discount for every extra vehicle that you insure and the providers are just happy to have the business. You can also amend the policy so that people can share the driving and use each others’ vehicles.