If your existing mortgage has come to an end and you are now paying a much higher Standard Variable Rate (SVR), this would be a perfect time to remortgage. Frustratingly, mortgage providers in the UK have become increasingly strict over the last few years and borrowers now face much tougher affordability checks. Even those whose financial circumstances haven’t changed are faced with rejected mortgage applications.

This is even tougher if you have bad credit. It is unlikely that you would have always had bad credit, since getting your first mortgage would have required a certain creditworthiness. But emergencies and circumstances can happen that cause missed payments, defaults and other things that impact our credit ratings.

However, the potential saving by remortgaging can be enormous. If you can move away from your Standard Variable Rate of 4-5% and get to an introductory offer of 1.3%-1.7% per month, the average household can save up £4,000 per year, according to figures from Remortgage Quotes Online.

So How Can You Get a Remortgage If You Have Bad Credit?

Smart Ways To Improve Your Credit Score

The ideal scenario for your credit score would be to pay off all your debts and outstanding loans – but very few of us have that kind of disposable income. There are other ways to improve your score, such as closing down any credit cards and store cards that you are no longer using.

By having a lot of credit on tap, you potentially have access to a lot of funds and this can impact your credit rating or make you less attractive to lenders. However, you are probably not even using most of these cards and probably signed up due to an incentive. So it is best to close anything that you are not using.

In addition, if possible, disassociate yourself from any joint accounts if the other person has bad credit, because it is assumed that you will be helping them if they need money. This includes things like existing mortgages, joint accounts and car finance.

Another good tip is to use credit builder credit cards which are specifically used to help you build up your credit score. Obviously you have to balance this with having too many cards open – so manage this effectively.

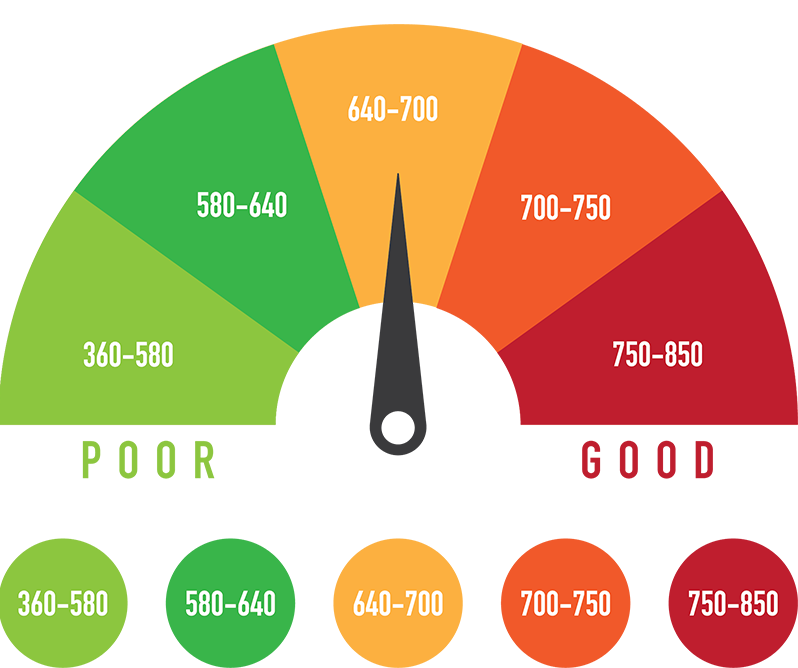

But, get into the swing of checking your credit score regularly and working hard to improve it. You can get a free report for just £2 through the government or you can use free trials or pay just a few pounds per month through the likes of Noddle, Experian or ClearScore.

Consolidate Your Debts Through Your Mortgage

If you have a lot of outstanding debts (school fees, student loan, credit cards, car finance, loans) and this is contributing to your bad credit problem, you can ask a mortgage lender or broker to help you consolidate these into your remortgage plan. This will allow you to pay off all your debts into one single monthly repayment and your mortgage too – and eventually you will debt free when it is paid off.

There are specific loan products to assist with this – so it is worth speaking to your advisor.

Use a Broker

Whilst we traditionally used the high street banks to get a mortgage or loan, there are now hundreds of different specialist mortgage lenders and thousands of brokers who can facilitate products for any requirement.

The rates and terms may vary, but specialist lenders are able to assist for people with bad credit or the self-employed. In particular, you may have success with non status lenders, who do not run credit checks as part of the application (hence the loan is not subject to status) – but instead they will look at the value and growth of your property and how much equity you have in it.