The payday loans industry has played a pivotal role in society for the last 10 or 20 years. Studied in A-Level Economics, payday loans will essentially fill the gap in income for many Britons and Americans every year who just need a little more money to see them through the month. Whether it is an emergency bill or just staying on top of your monthly expenses, the process of borrowing a few hundred pounds or dollars here or there is crucial for the millions of people that use it every year.

Whilst important to society and always controversial due to the high rates charged, the British and American process is very different, certainly in terms of regulation, loan processes, rates and more – and this piece is designed to outline the main differences.

Payday Loans By Numbers

- 3 million borrowers per year (UK)

- 12 million borrower per year (US)

- Around 50 payday lenders (UK)

- Around 23,000 payday lenders (US)

What Are The Main Differences Between the UK and US Market?

As someone who has worked in both the US and UK lending markets, here is my overview below:

The UK Market

“The UK market is 100% online. There were payday loan stores, which was monopolised by “The Money Shop” but they have since gone into administration. The payday lending market was around 20 years ago but probably reached its peak around 2012, where it was valued at around £2 billion per year. There were some notable lenders such as PaydayUK, but it wasn’t until Wonga.com that came along and really commercialised the space, taking it to TV, sponsoring football teams and turning payday lending into a mainstream product and no longer taboo.”

“At its peak, there were over 200 lenders and probably more than 2,000 brokers selling leads. Entrepreneurs and companies took advantage of the relaxed regulation and pushed high fees, aggressive collection practices and data was being resold and resold and resold. Eventually everyone wanted in on the payday loan boom which attracted interest and investment from large teams in Estonia, Israel, Australia and of course, America.”

“The FCA was brought in to regulate the industry in 2015 and it has been downhill for the market since then. A firm price cap of 0.8% and very strict lending requirements saw the industry reduce in size by maybe 60%-80% overnight. In the last 2 years, the FCA have encouraged ex-borrowers to claim over mis-sold loans, allowing you to claim a full refund and interest on top. This put some of the biggest lenders out of business within a couple of months, with Wonga.com refunding over £500 million (although the initial figure was £4 billion), followed by QuickQuid, The Money Shop, PiggyBank and Uncle Buck also seeing the same fate.”

The US Market

“The US market has a much larger store presence, with something like over 20,000 payday stores across America, apparently more outlets than McDonalds.

In addition, the regulatory approach is very State-oriented compared to the UK which follows one rulings for the entire country. In the US, payday loans are legalised in 37 states and you will typically need to be run by a Native American tribe or partnered with one in order to trade.

The market is still very large, with around 12 million borrowers per year. Once the product came online around 10 years, it was brutally extorted for commercial gain, tying people customers with very wordy agreements that would escalate the value of the loan massively – through very obscure wording and massive lack of transparency. I doubt a qualified lawyer would even understand how the loan repayments worked. For one payday kingpin, he is currently serving 16 years in prison.

Today it is more regulated and there are much stricter rules to protect consumers, making it more online and safer for borrowers,”

More from Business

- Can VoIP Transform Calls Beyond Cost? What’s Next

- What Is An Equity Fund?

- Top Industries for Investment in Paraguay

- Jean-Claude Bastos: How Unconventional Investment Methodology Built a Multi-Billion Global Portfolio Through Market Dislocations

- 10 Tools to Test and Monitor Your VoIP Performance

- How To File Tax Returns For Your Side Hustle

- How To Launch A Startup In Barcelona

- What Happens If Your Business Broadband is Too Slow?

Who Are The Biggest Payday Lenders in the UK?

Historically, Wonga.com was the biggest market leader, closely followed by QuickQuid and other strong brands such as PaydayUK, WageDay Advance, Uncle Buck and many more. In fact, there were many sizeable lenders which were not even household names, but with loan books of several tens of millions.

Who Are The Biggest Payday Lenders in the US?

CashEuroNet is one of the largest lenders which also the owner of QuickQuid and Pounds to Pockets in the UK.

Other well-known lenders in the US include Ace Cash Express, Dollar Financial and Lend Up.

Why Are Payday Loan Rates So High?

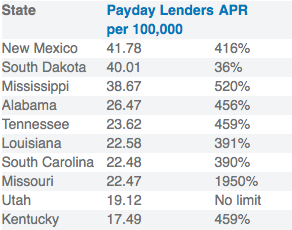

Payday loan rates are high, there is no question about it. In the UK, it is around 1,000-1,200% APR as the sweet spot and for the US, it tends to hover around the 400% APR mark.

Payday products are unsecured meaning that customers do not have to use anything physical as collateral to be approved, such as their car, home or valuable item. So when a lender is giving a loan to someone, often with very bad credit, they have very little that they can recover if the customer does not repay. Therefore, given that default rates can be quite high in the industry (around 20%), a high interest rate is charged to balance this out.

In addition, the running costs for payday lenders are quite high, often not realised by journalists and detractors. To be regulated, compliant and run a series of underwriting processes credit checks, banking checks and phone calls will incur costs. So whilst a customer may borrow £300 and repay £425 over 3 months, of the £125 gross profit, there are other fees such as acquisition (£5), underwriting and checks (£5), fast payment (£5) and all other running costs such as legals, marketing and staff.

What is the Future of Payday Loans?

The future of payday lending certainly moves towards greater regulation and giving much more safety and rights for borrowers, instead of lenders.

Lenders will face tighter margins and have to follow much stricter rules in order to trade. So whilst it remains profitable for some in the US and UK, we are moving towards more payday loan alternatives, like flexible overdraft facilities, much lower rates and ultimately those more expensive, traditional lenders could exit the market if it is no longer profitable.

So I think you will see the market adapting, the UK has certainly been transformed, since today there are probably no more than 50 lenders (at a push) – and alternatives such as salary finance and peer-to-peer are starting to gain more market share.