Peter Briffett is the CEO of Wagestream, the fintech app that is disrupting the consumer credit industry in the UK by not offering credit.

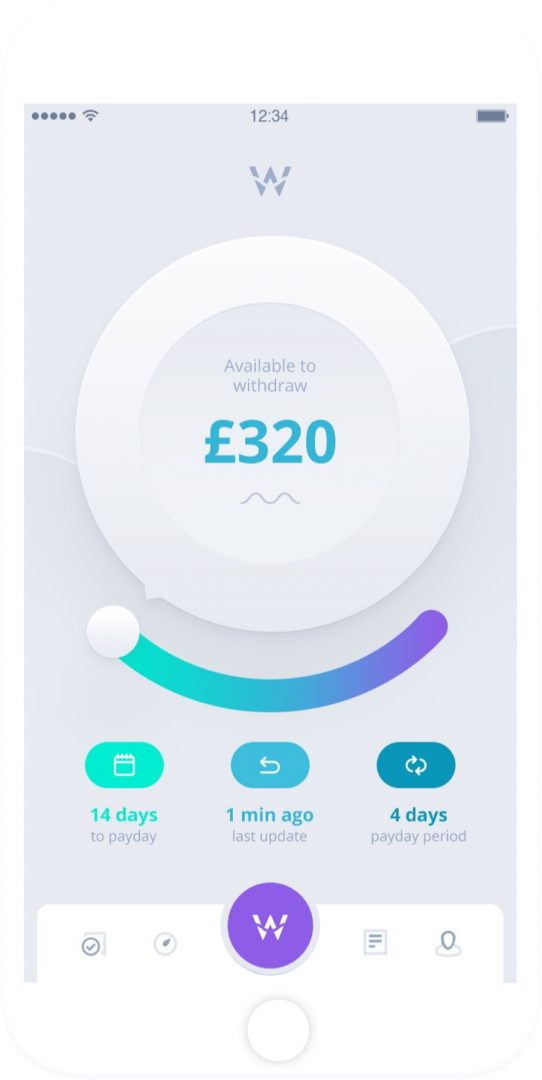

Wagestream offers a way for employees to dip into their wages before their official pay date – allowing them to draw down a percentage of their accrued earnings through an app when they need it and avoid the risk of high cost borrowing.

The start-up raised over £40 million in funding last year and has made headlines with its guerrilla marketing which includes holding up gravestones saying ‘death to Wonga’ and stating that ‘payday lending will be extinct by 2023’.

Tell Us About Wagestream

Wagestream was set up to tackle high cost lending and the debt spiral that many have suffered in the UK due to payday loans.

Our product stops people from getting into debt and allows them to take out money that they have already earned from their employer – rather than wait until payday.

We are giving people their liquidity back and, by integrating with employers and their HR systems, we can offer every worker the money they have earned but not been paid, in real-time. We have found the need for short term, high interest credit solutions are eradicated if people are given access to their earned income. This is because most predatory lenders profit by taking advantage of the cash flow issues many workers encounter between pay cycles.

A recent survey among our clients showed that using Wagestream had caused a 16% fall in staff attrition (staff leaving the company). When people could choose getting paid daily, weekly or monthly they obviously chose getting paid much sooner, rather than later. And when it came down to choosing one job over another, they stuck with the employer using Wagestream.

“We are changing the incentive structure of financial products”

Banks will always sell loans and want to make money from financial products, whereas an employer’s incentive to offer financial solutions to their staff will be the polar opposite; they want to offer fair financial products that lead to higher rates of staff engagement, increasing staff welfare and happiness.

Positive financial products are highly emotive and can have a really beneficial impact on someone’s life. Forward thinking businesses are seeing the recruitment and retention benefits of adopting these, and as such fueling a new trend known as ‘workplace banking’.

Wagestream is at the forefront of providing these solutions – our technology is being used by 100s of companies and is changing the incentive structure of how financial products are distributed.

For income streaming, Wagestream charges just £1.75 for an employee to make a stream of any size, which is the equivalent of an ATM charge. And the employer pays around £1 per employee per month.

How Do You Avoid Employees Abusing The Drawdown Option?

Remarkably, our users have demonstrated that they are more responsible when it’s their own money compared to money they borrow from an overdraft or credit card. This was an unexpected nuance. People are using the app for genuine emergencies and not frivolously.

Approximately 90% of our users take out around 10% of their wages but employers can cap it at 40% or by the number of times they can use it each month.

How Has Wagestream Been Impacted by COVID-19?

Wagestream has been inundated with enquiries during the coronavirus pandemic.

Employers have moved financial wellness solutions to the top of their agenda – we’re talking about grocers, hospitality businesses, large retailers and other big employers.

We have ensured 80K hospitality workers have instant access to their furloughed wages, and we helped BUPA get emergency funds to their most vulnerable staff. Above all, we were happy to waive all fees for frontline health workers in the NHS.

What Are Wagestream’s Plans Going Forward and After COVID-19?

We believe that financial health is going to be sorely tested in Q3 and Q4 of this year and companies are going to be looking at how they can help their staff. Wagestream will be looking to get sick pay to people as quickly as possible and give staff early access to any money they earn during overtime.

Currently, we work with around 120 large companies and 250,000 employees, mostly in hospitality, retail, healthcare and security. With increased demand and proof of concept, we are going to expand into manufacturing and construction too.

“Credit is not the route to financial wellness, but we do need it.”

The government and banks have been excellent at assisting with mortgage and payment holidays, but there could be a potential cash crisis on the horizon.

Credit is not the route to financial wellness, but we do need it. Our view is that if you have regular access to your wages and the fees are low, you won’t have to go looking for a loan elsewhere.

Many personal finance apps are good at categorising your spend, like Monzo and Revolut, but no one can see what your finances will look like in the future.

However Wagestream can link to workforce management systems, look at your rota, as well as the shifts and hours you are working, to give you an indication of your future financial health – and we’ve learnt that this helps people make better financial decisions today.

Peter Briffett was talking to Daniel Tannenbaum of TechRound. For more information, visit: wagestream.com