The launch of the Clim8 Impact investment app coincides with sustainable funds outperforming the market.

-

Money flowing into sustainable investment products has more than doubled to £348 billion in 2020

-

Sustainable funds outperformed the market in 2020 and there is strong evidence to suggest they will continue to do so

-

Clim8’s portfolios posted strong returns since inception in August 2020

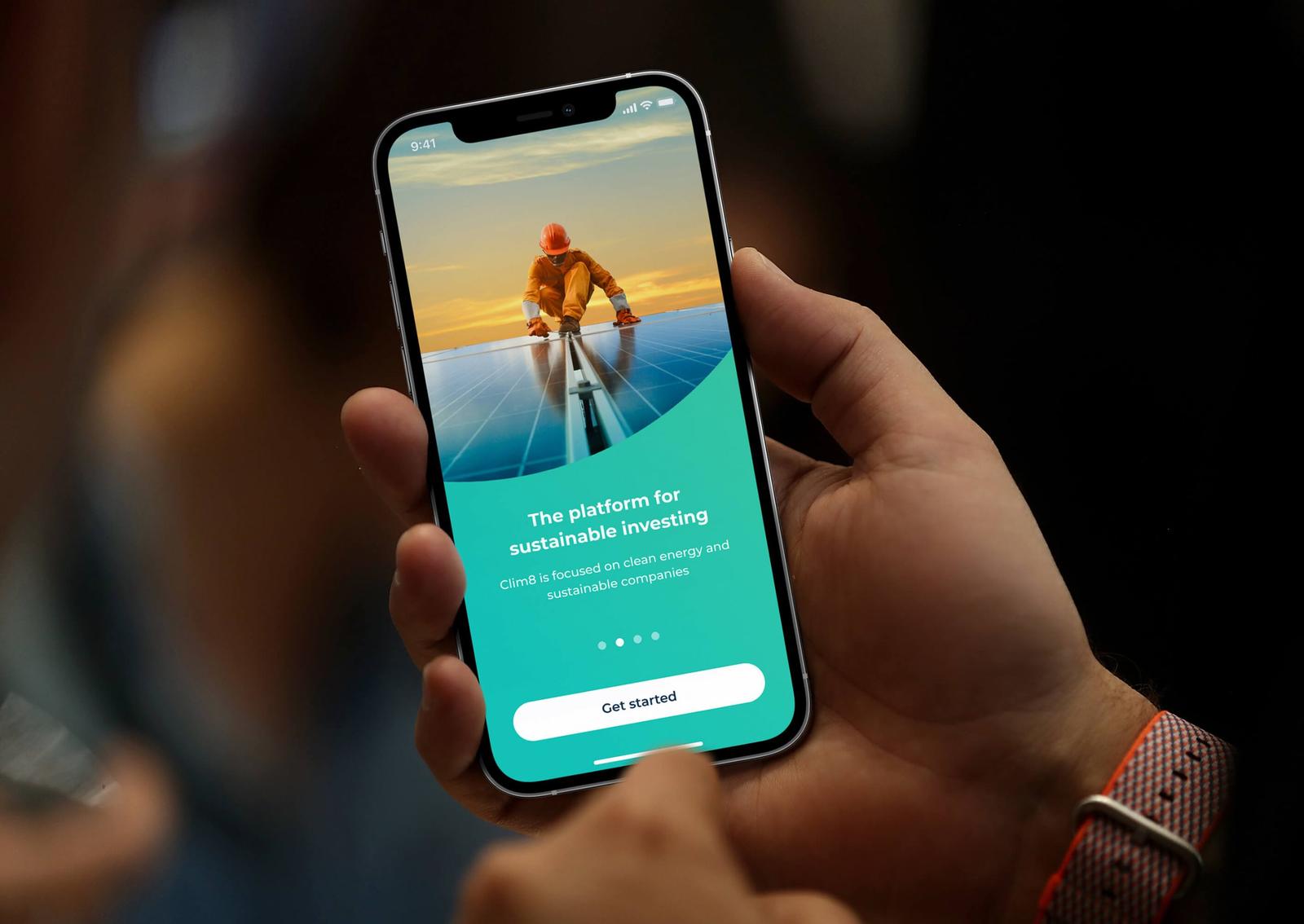

Clim8 Launches Mobile App

Clim8 Invest (Clim8), the investment platform to help consumers invest in companies, and their supply chains that are focused on tackling climate change, has today announced the launch of its mobile app.

Offering a range of portfolios to suit different risk profiles, the Clim8 Invest app empowers people to make a real, positive impact on climate change with the potential to enjoy a return on their investment. Core themes are clean energy, cleantech; smart mobility; clean water; circular economy; and sustainable food.

Over the last 12 months, based on a mixture of simulated and actual past performance Clim8’s balanced portfolio has performed well and returned 18.57%, significantly ahead of its benchmark (50% MSCI World Equities, 50% Barclays Bloomberg Global Aggregate Bond). The comparative benchmark performance over the past 10 years is 8.21%.

2021 – Focus on Sustainable Investment

“We are launching at an exciting time for sustainable investing. 2020 was an exceptional year for environmentally-focused investment offerings such as ours, as investors looked harder at climate related opportunities,” said Duncan Grierson, CEO of Clim8 . “Sustainable investments have continued to outperform markets since the beginning of the Covid-19 Crisis and we believe this will continue.”

Sustainable fund inflows more than doubled in 2020 for equity reaching $348 bn compared to $166 bn in 2019. Additionally, sustainable funds tracked by Morningstar (actively managed and passive strategies) outperformed the market. In the US, the outperformance over the S&P 500 reached 400 bp, and 345 bp in developed countries ex-US.

“Not only is sustainable investment becoming mainstream, we believe it has the basis for sustained out-performance in the medium-term, irrespective of views on the environmental crisis,” said Vincent Gilles, Chief Investment Officer, Clim8 Invest. “We believe this outperformance can be explained by two main factors. The demise of the oil and gas sector² in which sustainable funds are typically not invested in and the defensive qualities of the more sustainable companies in a period of market turmoil.”

“Whatsmore, it is anticipated that billions if not trillions will be redeployed towards sustainable investment. Clean energy technologies are now economically competitive and will amplify the trend towards sustainable solutions. And as more evidence of the environmental crisis emerges, regulations will continue to get tougher for polluters.”

Putting their Expertise to Good Use

Gilles and his experienced investment team have developed an in-depth due diligence process for stock selection from a combined 50 years’ of experience in the energy focused capital markets. Key metrics include performance vs risk exposure, the management teams’ track record, company’s financial merits and how they work towards being aligned with the Paris climate agreement.

“We are focused on structural growth, sustainable returns, and competitive advantage. We filter companies that make the best use of their resources and show positive developments on carbon emissions relative to their sector & region. When assessing sustainability we use temperature alignment models to actively select companies that are working towards the Paris goals,” said Gilles.

The Clim8 Invest mobile app can be downloaded from the Apple and Android app stores.