Company: Brex

Founders: Henrique Dubugras & Pedro Franceschi, 2017

Website: https://www.brex.com/

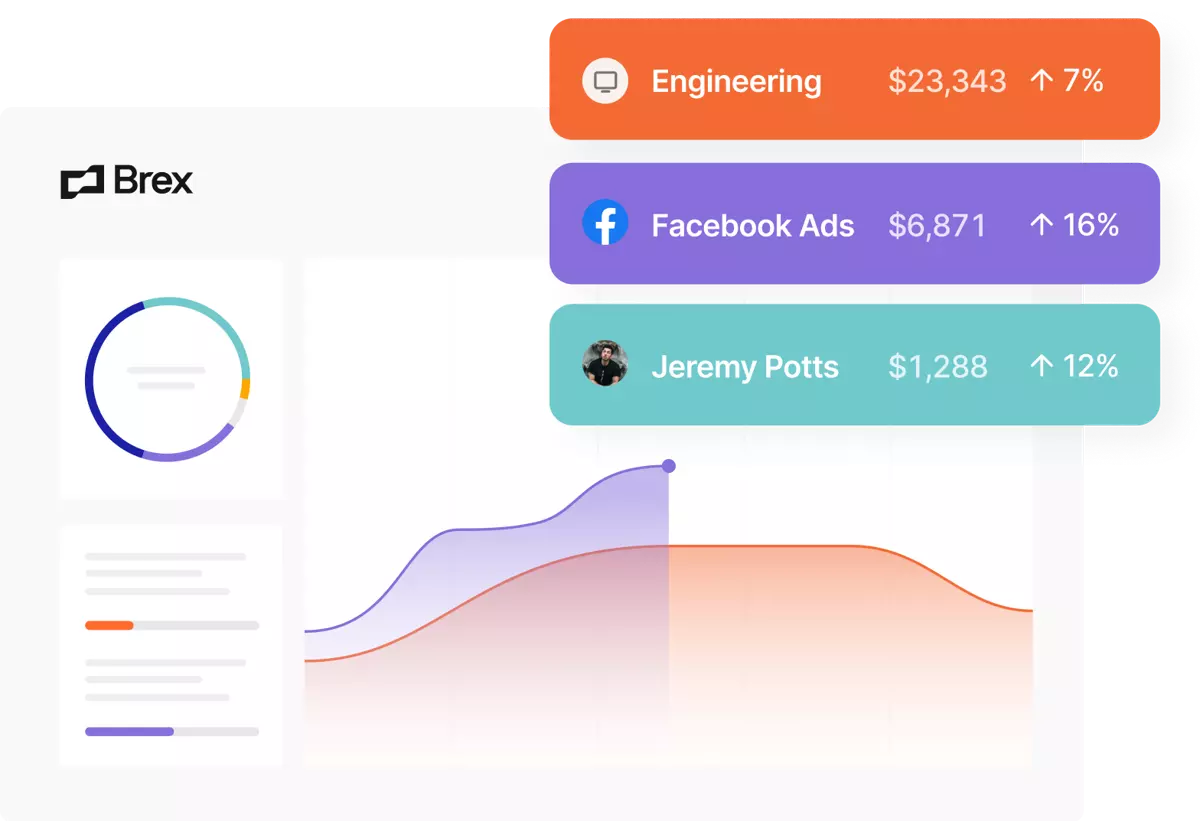

Business: All-in-one business finance solution to help businesses and teams stay focused on what they about most.

About Brex

Brex are here to serve the next generation of business. Thousands of businesses use Brex to manage their finances, including newly-founded startups, established tech companies, life sciences companies, and ecommerce brands. Brex helps founders and their teams stay focused on what they care about most.

Brex was born out of the frustration the founders faced when they were trying to get a corporate credit card for their startup. Brex extends credit to startups based on the amount of money in their corporate bank accounts. Early-stage startups have long had difficulty obtaining credit cards because they don’t have significant revenue. As such, traditional credit card issuers often reject their applications, forcing principals and founders to use their personal credit cards to fund operations.

Brex acts as an all-in-one finance solution for your business. You can issue unlimited virtual cards to your team and create unique cards with custom limits for each subscription, vendor, and employee. You’ll avoid costly surprises by setting custom limits and giving users approved ways to spend for specific items, like training or work from home snacks.

“The internet made almost everything you need to run a business more accessible: marketing tools, servers, email accounts—except for money. Everything about business has changed, but banks have not. The small businesses of the future are looking more like startups, and banks can’t build what they need.

To realise their potential, they need products that empower this new way of thinking and keep them moving. You should be able to apply for financial services like you set up an email address—in minutes, all online. So we’re building the financial OS to integrate the services and software they’ll need along their way. While they build the future, we’ll be building everything businesses will need to launch confidently, scale fast, and realise their full potential.”

Does Your Business Need Funding? Get Funding – Enquire Today >>>

The TechRound 100 is proudly sponsored by